| Zacks Company Profile for Asbury Automotive Group, Inc. (ABG : NYSE) |

|

|

| |

| • Company Description |

| Asbury Automotive Group, Inc. is one of the largest automotive retailers. Asbury offers customers an extensive range of automotive products and services, including new and used vehicle sales and related financing and insurance, vehicle maintenance and repair services, replacement parts and service contracts. They sell used vehicles at all franchised dealership locations and stand-alone stores. Used vehicle sales include the sale of used vehicles to individual retail customers and the sale of used vehicles to other dealers at auction. They provide vehicle repair and maintenance services, sell replacement parts, and recondition used vehicles at all of our dealerships.

Number of Employees: 15,000 |

|

|

| |

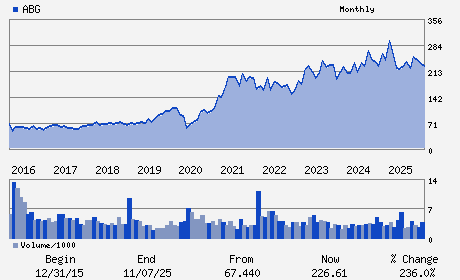

| • Price / Volume Information |

| Yesterday's Closing Price: $229.44 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 214,362 shares |

| Shares Outstanding: 19.44 (millions) |

| Market Capitalization: $4,460.54 (millions) |

| Beta: 0.82 |

| 52 Week High: $306.46 |

| 52 Week Low: $201.68 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.67% |

-6.21% |

| 12 Week |

8.77% |

4.04% |

| Year To Date |

-1.33% |

0.85% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

David W. Hult - Chief Executive Officer; President and Director

Thomas J. Reddin - Chairman

Michael D. Welch - Senior Vice President and Chief Financial Officer

Nathan E. Briesemeister - Vice President

Joel Alsfine - Director

|

|

Peer Information

Asbury Automotive Group, Inc. (RVEE)

Asbury Automotive Group, Inc. (WKSP)

Asbury Automotive Group, Inc. (CRMT)

Asbury Automotive Group, Inc. (ACCA)

Asbury Automotive Group, Inc. (UGLY)

Asbury Automotive Group, Inc. (LAD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RET/WHLSL AUTO/TRUCK

Sector: Retail/Wholesale

CUSIP: 043436104

SIC: 5500

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 19.44

Most Recent Split Date: (:1)

Beta: 0.82

Market Capitalization: $4,460.54 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $6.59 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $27.66 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |