| Zacks Company Profile for AECOM (ACM : NYSE) |

|

|

| |

| • Company Description |

| Aecom is a leading solutions provider for supporting professional, technical and management solutions for diverse industries across end markets like transportation, facilities, government as well as those in environmental, energy and water businesses. It specializes in providing integrated services for planning, construction and maintenance of infrastructures that includes consulting, architecture, engineering as well as managing the requirements for energy, water and environment to various private and public clients. It mainly focuses on providing fee-based services and is driven by knowledge-based services. It has 3 operating segments: Americas, International and AECOM Capital (ACAP). Americas serves commercial and government clients in major end markets of the U.S., Canada & Latin America. International unit focuses on commercial and government clients in major markets of Europe, the Middle East, Africa, India and the Asia-Pacific regions. ACAP includes investments primarily in real estate projects.

Number of Employees: 51,000 |

|

|

| |

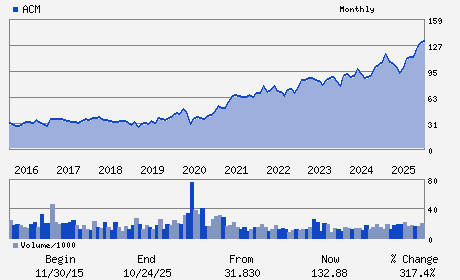

| • Price / Volume Information |

| Yesterday's Closing Price: $88.31 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,728,149 shares |

| Shares Outstanding: 129.29 (millions) |

| Market Capitalization: $11,417.51 (millions) |

| Beta: 1.08 |

| 52 Week High: $135.52 |

| 52 Week Low: $85.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-11.01% |

-9.60% |

| 12 Week |

-16.80% |

-20.42% |

| Year To Date |

-7.36% |

-7.12% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Troy Rudd - Chairman and Chief Executive Officer

Gaurav Kapoor - Chief Financial Officer

Bradley W. Buss - Director

Derek J. Kerr - Director

Kristy Pipes - Director

|

|

Peer Information

AECOM (TURN)

AECOM (FWLT)

AECOM (CTAK)

AECOM (AVNA)

AECOM (NLX.)

AECOM (T.AGR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ENGINRG/R&D SVS

Sector: Construction

CUSIP: 00766T100

SIC: 8711

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 129.29

Most Recent Split Date: (:1)

Beta: 1.08

Market Capitalization: $11,417.51 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.40% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.50 |

Indicated Annual Dividend: $1.24 |

| Current Fiscal Year EPS Consensus Estimate: $5.98 |

Payout Ratio: 0.20 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.05 |

| Estmated Long-Term EPS Growth Rate: 14.30% |

Last Dividend Paid: 01/07/2026 - $0.31 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |