| Zacks Company Profile for Adobe Inc. (ADBE : NSDQ) |

|

|

| |

| • Company Description |

| Adobe Inc. is one of the largest software companies in the world. Adobe picks up licensing fees from customers, which form the bulk of its revenue. The company also offers technical support and education, which account for the balance. The company operates through three segments. The Digital Media solutions segment enables small businesses and enterprises to create highly compelling content, deliver it across diverse media through smartphones, tablets, e-readers, and other devices, and then optimize it through systematic targeting and measurement. Within Digital Media, the two major components of revenue are the Creative family of products and Document Services products. The target customers are traditional content creators, web application developers, digital media professionals and user interface designers/developers, writers, videographers and photographers.

Number of Employees: 31,360 |

|

|

| |

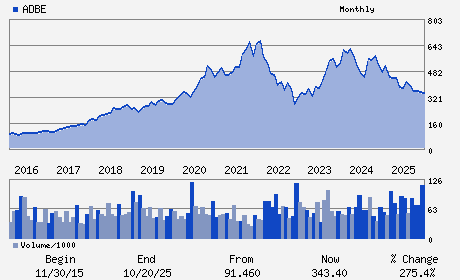

| • Price / Volume Information |

| Yesterday's Closing Price: $263.97 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,926,144 shares |

| Shares Outstanding: 410.50 (millions) |

| Market Capitalization: $108,359.69 (millions) |

| Beta: 1.51 |

| 52 Week High: $464.99 |

| 52 Week Low: $251.10 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.19% |

-11.82% |

| 12 Week |

-15.50% |

-19.18% |

| Year To Date |

-24.58% |

-24.86% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

345 PARK AVE

-

SAN JOSE,CA 95110

USA |

ph: 408-536-6000

fax: 408-537-6000 |

ir@adobe.com |

http://www.adobe.com |

|

|

| |

| • General Corporate Information |

Officers

Shantanu Narayen - Chief Executive Officer and Chair of the Board of

Daniel Durn - Executive Vice President and Chief Financial Offic

Jillian Forusz - Senior Vice President and Chief Accounting Officer

Frank Calderoni - Director

Cristiano Amon - Director

|

|

Peer Information

Adobe Inc. (ATEA)

Adobe Inc. (BITS.)

Adobe Inc. (DCTM)

Adobe Inc. (DLVAZ)

Adobe Inc. (DOCC)

Adobe Inc. (NEON)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-SOFTWARE

Sector: Computer and Technology

CUSIP: 00724F101

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: November

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 03/12/26

|

|

Share - Related Items

Shares Outstanding: 410.50

Most Recent Split Date: 5.00 (2.00:1)

Beta: 1.51

Market Capitalization: $108,359.69 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $4.85 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $19.00 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 15.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 13.38% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/12/26 |

|

|

|

| |