| Zacks Company Profile for Air Liquide (AIQUY : OTC) |

|

|

| |

| • Company Description |

| Air Liquide's core business is to supply oxygen, nitrogen, hydrogen and many other gases and services to most industries (for example: steel, oil refining, chemicals, glass, electronics, healthcare, food processing, metallurgy, paper and aerospace). Their global presence (130 subsidiaries in more than 65 countries) allows them to combine the resources and expertise of a global enterprise with a powerful local presence based on independent customer-focused teams.

Number of Employees: 66,500 |

|

|

| |

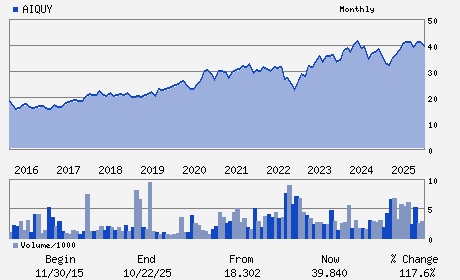

| • Price / Volume Information |

| Yesterday's Closing Price: $40.15 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 316,419 shares |

| Shares Outstanding: 2,896.93 (millions) |

| Market Capitalization: $116,311.54 (millions) |

| Beta: 0.84 |

| 52 Week High: $43.12 |

| 52 Week Low: $34.76 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.75% |

10.40% |

| 12 Week |

4.86% |

1.28% |

| Year To Date |

6.90% |

7.04% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Francois Jackow - Chief Executive Officer

Beno?t Potier - Chairman of the Board

Jerome Pelletan - Chief Financial Officer

Michael J. Graff - Executive Vice President

Francois Abrial - Senior Vice President

|

|

Peer Information

Air Liquide (ENFY)

Air Liquide (EMLIF)

Air Liquide (GPLB)

Air Liquide (BCPUQ)

Air Liquide (CYT.)

Air Liquide (SOA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-DIVERSIFD

Sector: Basic Materials

CUSIP: 009126202

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: 02/20/26

|

|

Share - Related Items

Shares Outstanding: 2,896.93

Most Recent Split Date: 6.00 (1.10:1)

Beta: 0.84

Market Capitalization: $116,311.54 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.20% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.48 |

| Current Fiscal Year EPS Consensus Estimate: $1.55 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 9.71% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/20/26 |

|

|

|

| |