| Zacks Company Profile for Alkermes plc (ALKS : NSDQ) |

|

|

| |

| • Company Description |

| Alkermes plc, formed by the merger of Waltham, MA-based Alkermes, Inc. and Elan Drug Technologies (EDT), is a fully integrated global biopharmaceutical company that utilizes proprietary technologies to research, develop and commercialize, both with partners and on its own pharmaceutical products in major therapeutic areas. Alkermes holds a diversified product portfolio and a promising pipeline of candidates targeting major central nervous system (CNS) disorders including schizophrenia, depression, addiction and multiple sclerosis. Alkermes derives revenues on net sales of its proprietary products: Vivitrol & Aristada, and manufacturing and/or royalty revenues on net sales of products commercialized by the company's partners. These include Risperdal Consta, Invega Sustenna/Xeplion, Invega Trinza/Trevicta, Ampyra/Fampyra and Bydureon. Interesting late-stage candidate in the company's pipeline include nemvaleukin alfa developed for treating advanced solid tumors. Its proprietary drugs are Vivitrol & Aristada.

Number of Employees: 1,800 |

|

|

| |

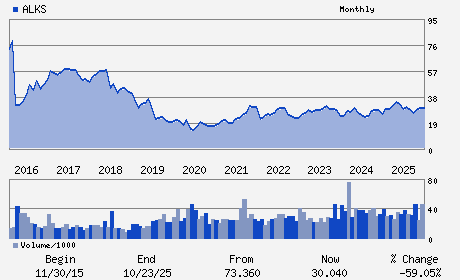

| • Price / Volume Information |

| Yesterday's Closing Price: $33.16 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,878,475 shares |

| Shares Outstanding: 165.12 (millions) |

| Market Capitalization: $5,475.30 (millions) |

| Beta: 0.49 |

| 52 Week High: $36.45 |

| 52 Week Low: $25.17 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.84% |

6.43% |

| 12 Week |

15.90% |

11.95% |

| Year To Date |

18.51% |

18.67% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Richard F. Pops - Chairman and Chief Executive Officer

Blair C. Jackson - Executive Vice President; Chief Operating Officer

Samuel J. Parisi - Vice President; Finance

Emily Peterson Alva - Director

Shane M. Cooke - Director

|

|

Peer Information

Alkermes plc (CORR.)

Alkermes plc (RSPI)

Alkermes plc (CGXP)

Alkermes plc (BGEN)

Alkermes plc (GTBP)

Alkermes plc (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: G01767105

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/25/26

|

|

Share - Related Items

Shares Outstanding: 165.12

Most Recent Split Date: 5.00 (2.00:1)

Beta: 0.49

Market Capitalization: $5,475.30 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.23 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.61 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/25/26 |

|

|

|

| |