| Zacks Company Profile for Alexander's, Inc. (ALX : NYSE) |

|

|

| |

| • Company Description |

| Alexander's, Inc. is a real estate investment trust engaged in leasing, managing, developing and redeveloping properties. Alexander's activities are conducted through its manager, Vornado Realty Trust.

Number of Employees: 103 |

|

|

| |

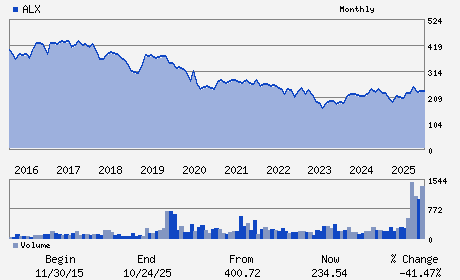

| • Price / Volume Information |

| Yesterday's Closing Price: $233.87 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 115,685 shares |

| Shares Outstanding: 5.11 (millions) |

| Market Capitalization: $1,194.44 (millions) |

| Beta: 0.81 |

| 52 Week High: $260.84 |

| 52 Week Low: $189.05 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.89% |

-1.41% |

| 12 Week |

12.68% |

8.84% |

| Year To Date |

7.31% |

7.46% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

210 ROUTE 4 EAST

-

PARAMUS,NJ 07652

USA |

ph: 201-587-8541

fax: 201-708-6214 |

None |

http://www.alx-inc.com |

|

|

| |

| • General Corporate Information |

Officers

Steven Roth - Chief Executive Officer and Chairman of the Board

Gary Hansen - Chief Financial Officer

Thomas R. DiBenedetto - Director

David Mandelbaum - Director

Mandakini Puri - Director

|

|

Peer Information

Alexander's, Inc. (ARE)

Alexander's, Inc. (CUZ)

Alexander's, Inc. (FUR)

Alexander's, Inc. (NNN)

Alexander's, Inc. (FCH)

Alexander's, Inc. (CTO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST -OTHER

Sector: Finance

CUSIP: 014752109

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 5.11

Most Recent Split Date: (:1)

Beta: 0.81

Market Capitalization: $1,194.44 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 7.70% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.08 |

Indicated Annual Dividend: $18.00 |

| Current Fiscal Year EPS Consensus Estimate: $12.08 |

Payout Ratio: 1.47 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.33 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |