| Zacks Company Profile for American Business Bank (AMBZ : OTC) |

|

|

| |

| • Company Description |

| American Business Bank provides a range of financial services to businesses in the middle market. Its various products and services include deposit services, cash management, commercial lending, international, and investment services. The bank's cash management services include deposit of employees' wages directly into their account; process transfers and vendor payments; and processing other debit and credit transactions specific to the client's business. The bank's commercial lending services include revolving lines of credit, asset-based lending, commercial loans, equipment financing, term lending, specialty lending, construction loans, and real estate loans. The company also offers online banking services. The bank's clients include wholesalers, manufacturers, service businesses, professionals, and non-profit organizations.

Number of Employees: |

|

|

| |

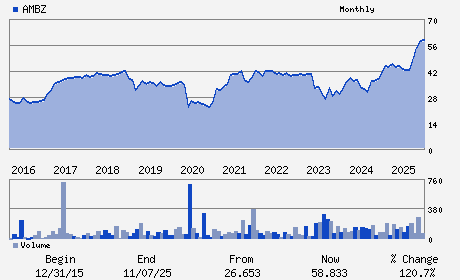

| • Price / Volume Information |

| Yesterday's Closing Price: $70.87 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,259 shares |

| Shares Outstanding: 8.88 (millions) |

| Market Capitalization: $629.31 (millions) |

| Beta: 0.32 |

| 52 Week High: $71.13 |

| 52 Week Low: $40.03 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

11.10% |

12.79% |

| 12 Week |

20.42% |

16.32% |

| Year To Date |

9.37% |

9.52% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

523 West 6th Street

-

Los Angeles,CA -

USA |

ph: 213-430-4000

fax: 213-627-2784 |

None |

http://www.americanbusinessbank.com |

|

|

| |

| • General Corporate Information |

Officers

- - -

- - -

- - -

- - -

- - -

|

|

Peer Information

American Business Bank (FBA)

American Business Bank (FVNB)

American Business Bank (FSNMQ)

American Business Bank (SRYPQ)

American Business Bank (BOKF)

American Business Bank (FHN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-SOUTHWEST

Sector: Finance

CUSIP: 02475L105

SIC: 6029

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 8.88

Most Recent Split Date: 8.00 (1.10:1)

Beta: 0.32

Market Capitalization: $629.31 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.41% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.17 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.13 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |