| Zacks Company Profile for Banco Do Brasil SA (BDORY : OTC) |

|

|

| |

| • Company Description |

| Banco do Brasil S.A provides retail and commercial banking services in Brazil and internationally. The services offered includes consumer, commercial, and agribusiness loans, asset management, foreign exchange, insurance, lease financing and Internet banking services. The Company also offers services including credit recovery, consortium administration, development, manufacture, commercialization, rent, and integration of digital electronic systems and equipment, peripherals, programs, inputs, and computing supplies. Banco do Brasil S.A is headquartered in Brasilia, Brazil.

Number of Employees: 86,574 |

|

|

| |

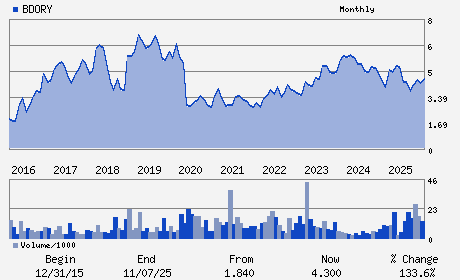

| • Price / Volume Information |

| Yesterday's Closing Price: $4.94 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 624,502 shares |

| Shares Outstanding: 5,730.83 (millions) |

| Market Capitalization: $28,310.32 (millions) |

| Beta: 0.39 |

| 52 Week High: $5.51 |

| 52 Week Low: $3.35 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

20.19% |

22.10% |

| 12 Week |

22.89% |

17.54% |

| Year To Date |

24.59% |

25.33% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Saun Quadra 5 Lote B Asa Norte

-

Brasilia,D5 70040-911

BRA |

ph: 55-61-4004-0001

fax: 55-61-3226-6087 |

ir@bb.com |

http://www.bb.com.br |

|

|

| |

| • General Corporate Information |

Officers

Tarciana Paula Gomes Medeiros - Chief Executive Officer

Marco Geovanne Tobias da Silva - Chief Financial Officer

Ana Cristina Rosa Garcia - Vice President

Alan Carlos Guedes de Oliveira - Director

Alberto Martinhago Vieira - Director

|

|

Peer Information

Banco Do Brasil SA (BKAU)

Banco Do Brasil SA (BKEAY)

Banco Do Brasil SA (BKNIY)

Banco Do Brasil SA (BKJAY)

Banco Do Brasil SA (ABNYY)

Banco Do Brasil SA (BNSTY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-FOREIGN

Sector: Finance

CUSIP: 059578104

SIC: 6021

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/21/26

|

|

Share - Related Items

Shares Outstanding: 5,730.83

Most Recent Split Date: 4.00 (2.00:1)

Beta: 0.39

Market Capitalization: $28,310.32 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.45% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.15 |

Indicated Annual Dividend: $0.02 |

| Current Fiscal Year EPS Consensus Estimate: $0.76 |

Payout Ratio: 0.08 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/04/2025 - $0.01 |

| Next EPS Report Date: 05/21/26 |

|

|

|

| |