| Zacks Company Profile for Baldwin Insurance Group, Inc. (BWIN : NSDQ) |

|

|

| |

| • Company Description |

| BRP Group Inc. is an insurance distribution firm. It provides insurance and risk management insights and solutions. The company operates primarily in the United States and internationally. BRP Group Inc. is based in Tampa, United States.

Number of Employees: 4,116 |

|

|

| |

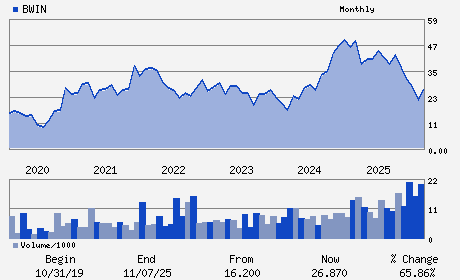

| • Price / Volume Information |

| Yesterday's Closing Price: $16.50 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,507,546 shares |

| Shares Outstanding: 118.65 (millions) |

| Market Capitalization: $1,957.70 (millions) |

| Beta: 1.33 |

| 52 Week High: $47.15 |

| 52 Week Low: $15.88 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-38.06% |

-37.12% |

| 12 Week |

-40.67% |

-42.69% |

| Year To Date |

-31.34% |

-31.24% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

4211 W. BOY SCOUT BLVD. SUITE 800

-

TAMPA,FL 33607

USA |

ph: 866-279-0698

fax: - |

ir@baldwin.com |

http://www.baldwin.com |

|

|

| |

| • General Corporate Information |

Officers

Trevor L. Baldwin - Chief Executive Officer

Lowry Baldwin - Chairman of the Board of Directors

Bradford L. Hale - Chief Financial Officer

Corbyn Lichon - Chief Accounting Officer

Jay Cohen - Director

|

|

Peer Information

Baldwin Insurance Group, Inc. (AGC.)

Baldwin Insurance Group, Inc. (T.GWO)

Baldwin Insurance Group, Inc. (AMH.2)

Baldwin Insurance Group, Inc. (CSLI.)

Baldwin Insurance Group, Inc. (CIA)

Baldwin Insurance Group, Inc. (DFG)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-LIFE

Sector: Finance

CUSIP: 05589G102

SIC: 6411

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/26/26

|

|

Share - Related Items

Shares Outstanding: 118.65

Most Recent Split Date: (:1)

Beta: 1.33

Market Capitalization: $1,957.70 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.54 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.35 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 20.28% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/26/26 |

|

|

|

| |