| Zacks Company Profile for CBL & Associates Properties, Inc. (CBLAQ : OTC) |

|

|

| |

| • Company Description |

| CBL & Associates Properties, Inc. is a fully integrated real estate investment trust which owns, develops, acquires, leases, manages, and operates regional shopping malls, open-air centers, community centers and office properties. The Company conducts substantially all of its business through its operating partnership. It owns two qualified REIT subsidiaries: CBL Holdings I, Inc. and CBL Holdings II, Inc. CBL & Associates Properties is headquartered in Chattanooga, Tennessee.

Number of Employees: 477 |

|

|

| |

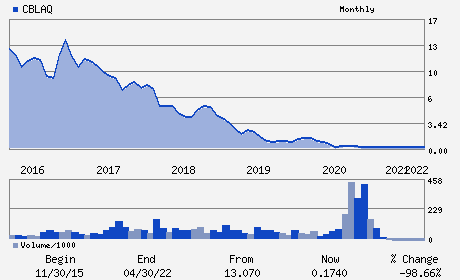

| • Price / Volume Information |

| Yesterday's Closing Price: $ |

Daily Weekly Monthly

|

| 20 Day Moving Average: shares |

| Shares Outstanding: (millions) |

| Market Capitalization: $ (millions) |

| Beta: |

| 52 Week High: $0.20 |

| 52 Week Low: $0.09 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

% |

% |

| 12 Week |

% |

% |

| Year To Date |

% |

% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Stephen D. Lebovitz - Chief Executive Officer

Stephen D. Lebovitz - Chief Executive Officer;Director

David J. Contis - Chairman of the Board

David J. Contis - Chairman of the Board

Benjamin W. Jaenicke - Executive Vice President - Chief Financial Officer

|

|

Peer Information

CBL & Associates Properties, Inc. (FRT)

CBL & Associates Properties, Inc. (PECO)

CBL & Associates Properties, Inc. (EQY)

CBL & Associates Properties, Inc. (SITC)

CBL & Associates Properties, Inc. (BFS)

CBL & Associates Properties, Inc. (ADC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST - RETAIL

Sector: Finance

CUSIP: 124830100

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 06/01/25

Next Expected EPS Date: 02/13/26

|

|

Share - Related Items

Shares Outstanding:

Most Recent Split Date: 6.00 (2.00:1)

Beta:

Market Capitalization: $ (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: % |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/13/26 |

|

|

|

| |