| Zacks Company Profile for Credit Agricole SA (CRARY : OTC) |

|

|

| |

| • Company Description |

| Credit Agricole S.A. markets a complete range of financial products and services. It offers savings, investments, life insurance, credit, payment and insurance services. Its activities are organized into three business lines: Central body: it ensures the cohesion and smooth functioning of the network, and represents the Group with banking authorities; Specialized business: it provides asset management, insurance, private banking, consumer credit, leasing, factoring and Banking and investment. The strength of its retail bank and know -how of its subsidiaries enable it to intervene in all areas of banking and finance. Credit Agricole is headquartered in Paris, France.

Number of Employees: 80,518 |

|

|

| |

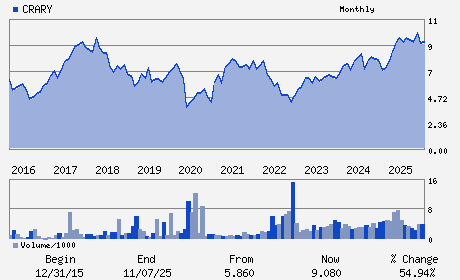

| • Price / Volume Information |

| Yesterday's Closing Price: $10.51 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 230,606 shares |

| Shares Outstanding: 6,051.81 (millions) |

| Market Capitalization: $63,604.47 (millions) |

| Beta: 0.65 |

| 52 Week High: $11.11 |

| 52 Week Low: $7.90 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.55% |

5.12% |

| 12 Week |

13.13% |

9.27% |

| Year To Date |

2.70% |

2.84% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

12 place des Etats-Unis

-

Montrouge,I0 92127

FRA |

ph: 33-1-57-72-90-45

fax: 33-1-57-72-26-41 |

None |

http://www.credit-agricole.com |

|

|

| |

| • General Corporate Information |

Officers

Philippe Brassac - Chief Executive Officer

Dominique Lefebvre - Chairman of the Board

Raphael Appert - Deputy Chairman of the Board

Bernard de Dree - Director

Caroline Catoire - Director

|

|

Peer Information

Credit Agricole SA (BKAU)

Credit Agricole SA (BKEAY)

Credit Agricole SA (BKNIY)

Credit Agricole SA (BKJAY)

Credit Agricole SA (ABNYY)

Credit Agricole SA (BNSTY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-FOREIGN

Sector: Finance

CUSIP: 225313105

SIC: 6029

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 6,051.81

Most Recent Split Date: (:1)

Beta: 0.65

Market Capitalization: $63,604.47 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.76% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.40 |

| Current Fiscal Year EPS Consensus Estimate: $1.34 |

Payout Ratio: 0.33 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |