| Zacks Company Profile for CVR Energy Inc. (CVI : NYSE) |

|

|

| |

| • Company Description |

| Headquartered in Sugar Land, Texas, CVR ENERGY, INC. is an independent refiner and marketer of high value transportation fuels and, through a limited partnership, a producer of ammonia and urea ammonia nitrate fertilizers. CVR Energy's petroleum business includes full-coking sour crude refinery in Coffeyville, Kan. In addition, CVR Energy's supporting businesses include a crude oil gathering system serving central Kansas, northern Oklahoma and southwest Nebraska; storage and terminal facilities for asphalt and refined fuels in Phillipsburg, Kan.; and a rack marketing division supplying product to customers through tanker trucks and at throughput terminals.

Number of Employees: 1,595 |

|

|

| |

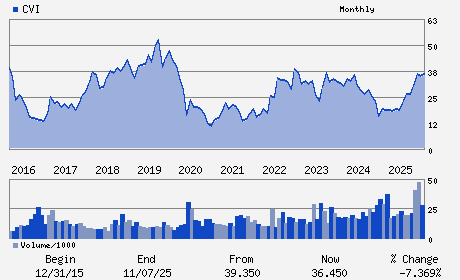

| • Price / Volume Information |

| Yesterday's Closing Price: $23.17 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,080,416 shares |

| Shares Outstanding: 100.53 (millions) |

| Market Capitalization: $2,329.28 (millions) |

| Beta: 1.16 |

| 52 Week High: $41.67 |

| 52 Week Low: $15.10 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.56% |

0.95% |

| 12 Week |

-32.80% |

-35.09% |

| Year To Date |

-8.92% |

-8.80% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

David L. Lamp - Chief Executive Officer; President and Director

Ted Papapostolou - Chairman

Dane J. Neumann - Executive Vice President; Chief Financial Officer;

Jeffrey D. Conaway - Vice President; Chief Accounting Officer and Corpo

Dustin DeMaria - Director

|

|

Peer Information

CVR Energy Inc. (CBPI.)

CVR Energy Inc. (NTOIY)

CVR Energy Inc. (AE)

CVR Energy Inc. (FUELQ)

CVR Energy Inc. (GI.)

CVR Energy Inc. (UDS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL REFING&MKTG

Sector: Oils/Energy

CUSIP: 12662P108

SIC: 2911

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/18/26

|

|

Share - Related Items

Shares Outstanding: 100.53

Most Recent Split Date: (:1)

Beta: 1.16

Market Capitalization: $2,329.28 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.02 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.38 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/18/26 |

|

|

|

| |