| Zacks Company Profile for DoorDash, Inc. (DASH : NSDQ) |

|

|

| |

| • Company Description |

| DoorDash, Inc. provides restaurant food delivery services. The Company develops technology to connect customers with merchants through an on-demand food delivery application. DoorDash, Inc. is based in San Francisco, United States.

Number of Employees: 23,700 |

|

|

| |

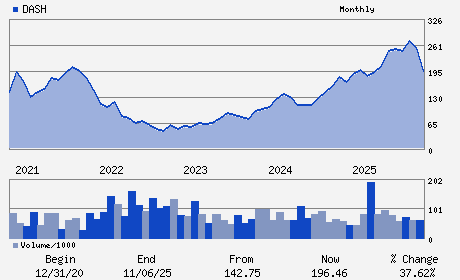

| • Price / Volume Information |

| Yesterday's Closing Price: $161.14 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,664,880 shares |

| Shares Outstanding: 431.00 (millions) |

| Market Capitalization: $69,451.10 (millions) |

| Beta: 1.77 |

| 52 Week High: $285.50 |

| 52 Week Low: $155.43 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-23.31% |

-22.05% |

| 12 Week |

-14.16% |

-17.86% |

| Year To Date |

-28.85% |

-28.72% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

303 2ND STREET SOUTH TOWER 8TH FLOOR

-

SAN FRANCISCO,CA 94107

USA |

ph: 650-487-3970

fax: - |

ir@doordash.com |

http://www.doordash.com |

|

|

| |

| • General Corporate Information |

Officers

Tony Xu - Chief Executive Officer

Ravi Inukonda - Chief Financial Officer

Gordon Lee - Chief Accounting Officer

Jeffrey Blackburn - Director

Shona L. Brown - Director

|

|

Peer Information

DoorDash, Inc. (BIZZ)

DoorDash, Inc. (DCLK)

DoorDash, Inc. (DGIN.)

DoorDash, Inc. (DVW)

DoorDash, Inc. (CYCHZ)

DoorDash, Inc. (IFXC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SERVICES

Sector: Computer and Technology

CUSIP: 25809K105

SIC: 7389

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/18/26

|

|

Share - Related Items

Shares Outstanding: 431.00

Most Recent Split Date: (:1)

Beta: 1.77

Market Capitalization: $69,451.10 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.64 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $3.14 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 14.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/18/26 |

|

|

|

| |