| Zacks Company Profile for Ennis, Inc. (EBF : NYSE) |

|

|

| |

| • Company Description |

| Ennis, Inc. is one of the largest private-label printed business product suppliers in the United States. Ennis offers an extensive product line from simple to complex forms, laser cut-sheets, negotiable documents, internal bank forms, tags, labels, presentation folders, commercial printing, advertising specialties, screen printed products, and point-of-purchase display advertising that can be custom designed to customer needs.

Number of Employees: 1,856 |

|

|

| |

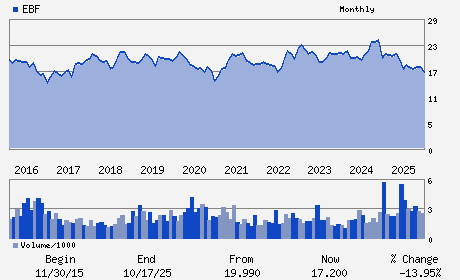

| • Price / Volume Information |

| Yesterday's Closing Price: $20.76 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 160,410 shares |

| Shares Outstanding: 25.29 (millions) |

| Market Capitalization: $525.08 (millions) |

| Beta: 0.37 |

| 52 Week High: $22.01 |

| 52 Week Low: $16.30 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.73% |

9.37% |

| 12 Week |

21.62% |

17.47% |

| Year To Date |

15.27% |

15.43% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2441 PRESIDENTIAL PARKWAY

-

MIDLOTHIAN,TX 76065

USA |

ph: 972-775-9801

fax: 800-645-8339 |

investor@ennis.com |

http://www.ennis.com |

|

|

| |

| • General Corporate Information |

Officers

Keith S. Walters - Chief Executive Office;Chairman and President

Vera Burnett - Chief Financial Officer; Treasurer

Aaron Carter - Director

John R. Blind - Director

Michael J. Schaefer - Director

|

|

Peer Information

Ennis, Inc. (CIX)

Ennis, Inc. (T.SXP)

Ennis, Inc. (DXT)

Ennis, Inc. (CIIG.)

Ennis, Inc. (DAYR)

Ennis, Inc. (GGIT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OFFICE SPPL&FRM

Sector: Industrial Products

CUSIP: 293389102

SIC: 2761

|

|

Fiscal Year

Fiscal Year End: February

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 04/20/26

|

|

Share - Related Items

Shares Outstanding: 25.29

Most Recent Split Date: 8.00 (1.50:1)

Beta: 0.37

Market Capitalization: $525.08 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.82% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.60 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.09 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/08/2026 - $0.25 |

| Next EPS Report Date: 04/20/26 |

|

|

|

| |