| Zacks Company Profile for ELEMENTIS (ELMTY : OTC) |

|

|

| |

| • Company Description |

| Elementis plc is a specialty chemicals company. Its business comprises of Specialty Products, Chromium and Surfactants. The company's product consists of BENTONE(R) organoclays, RHEOLATE(R) rheological additives, DAPRO(R) specialty additives, M-P-A(R) anti-settling agents, NALZIN(R) corrosion and rust inhibitors, THIXATROL(R) rheology additives, NUOSPERSE(R) wetting and dispersing agents, TINT-AYD (R)colorants, SLIP-AYD(R) waxes and slip additives, SERDOX(R) polyglycol ethers, SERDOLAMIDE(R) alkanolamides and SERVOXYL(R) phosphate esters. Elementis plc is based in London, United Kingdom.

Number of Employees: 1,200 |

|

|

| |

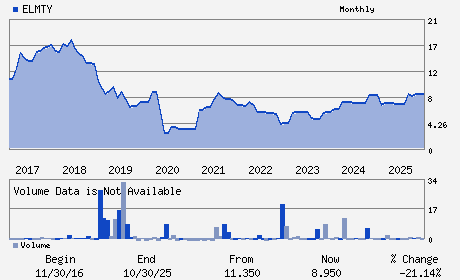

| • Price / Volume Information |

| Yesterday's Closing Price: $9.83 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 7 shares |

| Shares Outstanding: 142.32 (millions) |

| Market Capitalization: $1,399.04 (millions) |

| Beta: 0.15 |

| 52 Week High: $10.65 |

| 52 Week Low: $7.20 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

18.43% |

20.31% |

| 12 Week |

18.01% |

12.87% |

| Year To Date |

18.43% |

19.74% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

THE BINDERY 5TH FLOOR 51-53 HATTON GARDEN

-

LONDON,X0 EC1N 8HN

GBR |

ph: 44-20-7067-2999

fax: 44-0-20-7067-2998 |

None |

http://www.elementis.com |

|

|

| |

| • General Corporate Information |

Officers

Paul Waterman - Chief Executive Officer

John O`Higgins - Chairman

Ralph Hewins - Chief Financial Officer

Heejae Chae - Director

Trudy Schoolenberg - Director

|

|

Peer Information

ELEMENTIS (CSBHY)

ELEMENTIS (ARWM)

ELEMENTIS (FUL)

ELEMENTIS (IAX)

ELEMENTIS (AVD)

ELEMENTIS (ASH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-SPECIALTY

Sector: Basic Materials

CUSIP: 286190103

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 142.32

Most Recent Split Date: (:1)

Beta: 0.15

Market Capitalization: $1,399.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.84% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.08 |

| Current Fiscal Year EPS Consensus Estimate: $0.62 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |