| Zacks Company Profile for Enersys (ENS : NYSE) |

|

|

| |

| • Company Description |

| EnerSys Inc. engages in manufacturing, marketing and distribution of various industrial batteries world wide. It also develops battery chargers and accessories, power equipment and outdoor cabinet enclosures and aslo provides support services for clients. EnerSys has 3 operating business segments. Energy Systems segment offers products, used to provide backup power for operation of critical applications deployed in telecommunications systems, UPS applications for computer and computer-controlled systems, large-scale energy storage and energy pipelines and switchgear and electrical control systems and integrated power solutions and services for telecom, broadband, renewable and industrial customers. Motive Power segment's products are used for powering electric industrial forklifts. Specialty segment specializes in developing energy solutions for satellites, transportation, submarines, military aircraft, ships and other tactical vehicles apart from medical and security systems.

Number of Employees: 10,858 |

|

|

| |

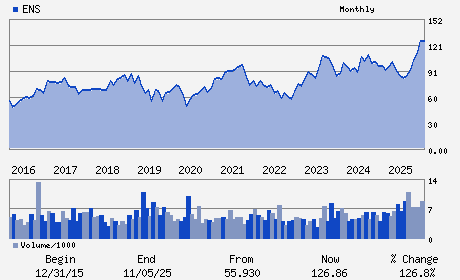

| • Price / Volume Information |

| Yesterday's Closing Price: $179.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 606,910 shares |

| Shares Outstanding: 36.85 (millions) |

| Market Capitalization: $6,603.77 (millions) |

| Beta: 1.10 |

| 52 Week High: $194.77 |

| 52 Week Low: $76.57 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.57% |

8.19% |

| 12 Week |

29.72% |

25.30% |

| Year To Date |

22.11% |

22.28% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

David M. Shaffer - Chief Executive Officer

Andrea J. Funk - Chief Financial Officer

Caroline Chan - Director

Steven M. Fludder - Director

David C. Habiger - Director

|

|

Peer Information

Enersys (BEZ.)

Enersys (FTEL)

Enersys (TECU)

Enersys (POWL)

Enersys (FELE)

Enersys (NIPNY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-ELECTRICAL

Sector: Industrial Products

CUSIP: 29275Y102

SIC: 3690

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/20/26

|

|

Share - Related Items

Shares Outstanding: 36.85

Most Recent Split Date: (:1)

Beta: 1.10

Market Capitalization: $6,603.77 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.59% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.99 |

Indicated Annual Dividend: $1.05 |

| Current Fiscal Year EPS Consensus Estimate: $10.32 |

Payout Ratio: 0.10 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 15.00% |

Last Dividend Paid: 12/12/2025 - $0.26 |

| Next EPS Report Date: 05/20/26 |

|

|

|

| |