| Zacks Company Profile for Flowers Foods, Inc. (FLO : NYSE) |

|

|

| |

| • Company Description |

| Flowers Foods, Inc. produces packaged bakery foods in the United States. The company specializes in baked food products as well as produces a wide range of breads, buns, rolls, snack cakes and tortillas. Some of the most popular brands of the company include: Nature's Own, Wonder, Dave's Killer Bread and Tastykake.

Number of Employees: 10,200 |

|

|

| |

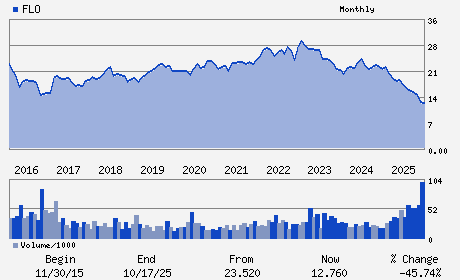

| • Price / Volume Information |

| Yesterday's Closing Price: $10.36 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,526,338 shares |

| Shares Outstanding: 211.18 (millions) |

| Market Capitalization: $2,187.81 (millions) |

| Beta: 0.33 |

| 52 Week High: $20.23 |

| 52 Week Low: $9.93 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.65% |

-4.21% |

| 12 Week |

-1.99% |

-5.33% |

| Year To Date |

-4.78% |

-4.65% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1919 FLOWERS CIRCLE

-

THOMASVILLE,GA 31757

USA |

ph: 229-226-9110

fax: 229-225-3816 |

None |

http://www.flowersfoods.com |

|

|

| |

| • General Corporate Information |

Officers

A. Ryals McMullian - Chairman and Chief Executive Officer

R. Steve Kinsey - Chief Financial Officer

Edward J. Casey - Director

Thomas C. Chubb - Director

George E. Deese - Director

|

|

Peer Information

Flowers Foods, Inc. (CDSCY)

Flowers Foods, Inc. (HDNHY)

Flowers Foods, Inc. (CPB)

Flowers Foods, Inc. (AMNF)

Flowers Foods, Inc. (GMFIY)

Flowers Foods, Inc. (BRID)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FOOD-MISC/DIVERSIFIED

Sector: Consumer Staples

CUSIP: 343498101

SIC: 2000

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/15/26

|

|

Share - Related Items

Shares Outstanding: 211.18

Most Recent Split Date: 6.00 (1.50:1)

Beta: 0.33

Market Capitalization: $2,187.81 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 9.56% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.32 |

Indicated Annual Dividend: $0.99 |

| Current Fiscal Year EPS Consensus Estimate: $0.85 |

Payout Ratio: 0.90 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.16 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 11/28/2025 - $0.25 |

| Next EPS Report Date: 05/15/26 |

|

|

|

| |