| Zacks Company Profile for Floor & Decor Holdings, Inc. (FND : NYSE) |

|

|

| |

| • Company Description |

| Floor & Decor Holdings, Inc. is a multi-channel specialty retailer of hard surface flooring and related accessories which offering a broad in-stock assortment of tile, wood, laminate and natural stone flooring. Floor & Decor Holdings, Inc. is headquartered in Smyrna, Georgia.

Number of Employees: 13,690 |

|

|

| |

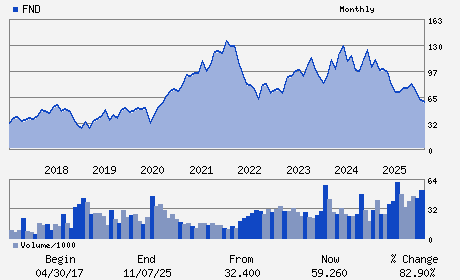

| • Price / Volume Information |

| Yesterday's Closing Price: $70.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,255,973 shares |

| Shares Outstanding: 107.76 (millions) |

| Market Capitalization: $7,564.48 (millions) |

| Beta: 1.74 |

| 52 Week High: $103.87 |

| 52 Week Low: $55.11 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.72% |

-6.31% |

| 12 Week |

15.99% |

12.04% |

| Year To Date |

15.29% |

15.45% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Thomas V. Taylor - Chief Executive Officer

Norman H. Axelrod - Chairman of the Board

George Vincent West - Vice Chairman of the Board

Bryan H. Langley - Executive Vice President and Chief Financial Offic

Nada A. Aried - Director

|

|

Peer Information

Floor & Decor Holdings, Inc. (ETD)

Floor & Decor Holdings, Inc. (SUPX)

Floor & Decor Holdings, Inc. (LECH)

Floor & Decor Holdings, Inc. (LIN.)

Floor & Decor Holdings, Inc. (RBDSQ)

Floor & Decor Holdings, Inc. (BBAO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-HOME FRN

Sector: Retail/Wholesale

CUSIP: 339750101

SIC: 5211

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/19/26

|

|

Share - Related Items

Shares Outstanding: 107.76

Most Recent Split Date: (:1)

Beta: 1.74

Market Capitalization: $7,564.48 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.42 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.15 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 12.01% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/19/26 |

|

|

|

| |