| Zacks Company Profile for GE Aerospace (GE : NYSE) |

|

|

| |

| • Company Description |

| GE Aerospace (erstwhile General Electric Company) is a leading designer, developer and producer of jet engines, components and integrated systems for military, commercial and business aircraft. The company is well-known for its aero-derivative gas turbines for marine applications. Its zeal to invest in upgrades and innovation of products along with outstanding service capabilities and technological expertise raises its competitive appeal. Founded in 1892, General Electric (now GE Aerospace) is currently headquartered in Evendale, OH. The company operates its businesses in the United States, Europe, Asia, the Middle East and Africa, and the Americas. Its products and services range from jet engines like LEAP, GE9X & GEnx, airframes, avionics systems, aviation electric power systems, turboprop engines, engine gear, and transmission components and services among others.

Number of Employees: 57,000 |

|

|

| |

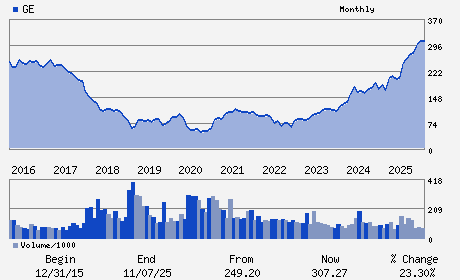

| • Price / Volume Information |

| Yesterday's Closing Price: $315.41 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,578,835 shares |

| Shares Outstanding: 1,048.81 (millions) |

| Market Capitalization: $330,806.31 (millions) |

| Beta: 1.40 |

| 52 Week High: $332.79 |

| 52 Week Low: $159.36 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.99% |

-1.51% |

| 12 Week |

9.73% |

5.99% |

| Year To Date |

2.40% |

2.54% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

H. Lawrence Culp - Chief Executive Officer and Chairman

Rahul Ghai - Chief Financial Officer and Senior Vice President

Robert Giglietti - Vice President; Chief Accounting Officer; Controll

Stephen Angel - Director

Sebastien M. Bazin - Director

|

|

Peer Information

GE Aerospace (BA)

GE Aerospace (HOVR)

GE Aerospace (HWM)

GE Aerospace (LMT)

GE Aerospace (TOD)

GE Aerospace (TXT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AEROSP/DEFENSE

Sector: Aerospace

CUSIP: 369604301

SIC: 3600

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/28/26

|

|

Share - Related Items

Shares Outstanding: 1,048.81

Most Recent Split Date: 8.00 (0.13:1)

Beta: 1.40

Market Capitalization: $330,806.31 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.46% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.64 |

Indicated Annual Dividend: $1.44 |

| Current Fiscal Year EPS Consensus Estimate: $7.45 |

Payout Ratio: 0.23 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: 14.55% |

Last Dividend Paid: 12/29/2025 - $0.36 |

| Next EPS Report Date: 04/28/26 |

|

|

|

| |