| Zacks Company Profile for Hingham Institution for Savings (HIFS : NSDQ) |

|

|

| |

| • Company Description |

| Hingham Institution for Savings is a Massachusetts-chartered savings bank which operates 3 banking facilities in Hingham and Hull, Massachusetts. The bank's services retail banking services including checking and savings accounts, certificates of deposit, money market accounts, passbook accounts, Keogh and individual retirement accounts, and automated teller machines. Its lending services include residential mortgages, construction installment loans, residential real estate loans, automobile loans, student loans, and home improvement loans.

Number of Employees: 92 |

|

|

| |

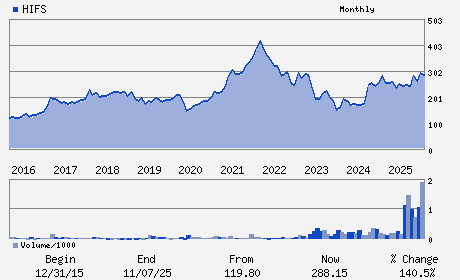

| • Price / Volume Information |

| Yesterday's Closing Price: $313.04 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 54,409 shares |

| Shares Outstanding: 2.18 (millions) |

| Market Capitalization: $683.10 (millions) |

| Beta: 1.02 |

| 52 Week High: $338.00 |

| 52 Week Low: $209.71 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.24% |

7.85% |

| 12 Week |

14.67% |

10.76% |

| Year To Date |

10.24% |

10.39% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

55 Main Street

-

Hingham,MA 02043

USA |

ph: 781-749-2200

fax: - |

None |

http://www.hinghamsavings.com |

|

|

| |

| • General Corporate Information |

Officers

Robert H. Gaughen, Jr. - Chief Executive Officer

Patrick R. Gaughen - President; Chief Operating Officer and Director

Cristian A. Melej - Vice President and Chief Financial Officer

Gaughen, Jr. - Director

Scott L. Moser - Director

|

|

Peer Information

Hingham Institution for Savings (CNBKA)

Hingham Institution for Savings (CNBI2)

Hingham Institution for Savings (CNOB)

Hingham Institution for Savings (FBNK.)

Hingham Institution for Savings (FMBN)

Hingham Institution for Savings (TBNK)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-NORTHEAST

Sector: Finance

CUSIP: 433323102

SIC: 6036

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/10/26

|

|

Share - Related Items

Shares Outstanding: 2.18

Most Recent Split Date: 10.00 (1.50:1)

Beta: 1.02

Market Capitalization: $683.10 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.81% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $2.52 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.17 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.06 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/05/2026 - $1.33 |

| Next EPS Report Date: 04/10/26 |

|

|

|

| |