| Zacks Company Profile for Hims & Hers Health, Inc. (HIMS : NYSE) |

|

|

| |

| • Company Description |

| Hims & Hers Health Inc. is a multi-specialty telehealth platform that connects consumers to licensed healthcare professionals, enabling medical care for numerous conditions related to mental health, sexual health, dermatology, primary care and more. Hims & Hers Health Inc., formerly known as Oaktree Acquisition Corp., is based in San Francisco.

Number of Employees: 1,637 |

|

|

| |

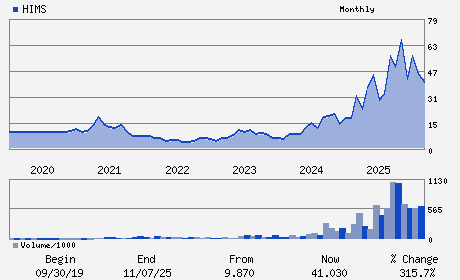

| • Price / Volume Information |

| Yesterday's Closing Price: $16.30 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 31,067,238 shares |

| Shares Outstanding: 227.65 (millions) |

| Market Capitalization: $3,710.68 (millions) |

| Beta: 2.43 |

| 52 Week High: $72.98 |

| 52 Week Low: $15.63 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-47.81% |

-46.98% |

| 12 Week |

-51.52% |

-53.63% |

| Year To Date |

-49.80% |

-51.25% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2269 CHESTNUT STREET SUITE 523

-

SAN FRANCISCO,CA 94123

USA |

ph: 415-851-0195

fax: - |

investors@forhims.com |

http://www.hims.com |

|

|

| |

| • General Corporate Information |

Officers

Andrew Dudum - Chief Executive Officer and Director

Oluyemi Okupe - Chief Financial Officer

Irene Becklund - Senior Vice President; Controller

Deborah Autor - Director

Patrick H. Carroll - Director

|

|

Peer Information

Hims & Hers Health, Inc. (HLIS)

Hims & Hers Health, Inc. (AZTA)

Hims & Hers Health, Inc. (APYI)

Hims & Hers Health, Inc. (RNVA)

Hims & Hers Health, Inc. (HMSY)

Hims & Hers Health, Inc. (LRSI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MEDICAL INFO SYS

Sector: Medical

CUSIP: 433000106

SIC: 8011

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/23/26

|

|

Share - Related Items

Shares Outstanding: 227.65

Most Recent Split Date: (:1)

Beta: 2.43

Market Capitalization: $3,710.68 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.13 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.55 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 9.81% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/23/26 |

|

|

|

| |