| Zacks Company Profile for Hannover Ruck SE (HVRRY : OTC) |

|

|

| |

| • Company Description |

| Hannover Rueckversicherung AG provides reinsurance services. The Company's operations are divided into four segments: property and casualty reinsurance, life and health reinsurance, financial reinsurance and specialty insurance. Hannover, through its subsidiaries, transacts all lines of non-life and life/health reinsurance. It offers non-life reinsurance products, including specialty lines comprising aviation and space; credit, surety, and political risks; marine, including offshore energy; and structured reinsurance products, which include insurance-linked securities. Hannover Rueckversicherung AG is based in Hannover, Germany.

Number of Employees: 4,139 |

|

|

| |

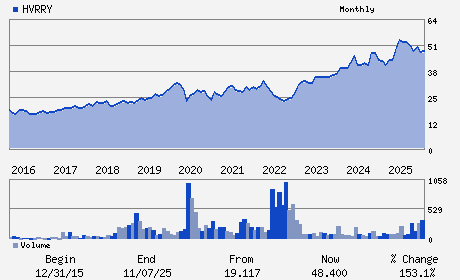

| • Price / Volume Information |

| Yesterday's Closing Price: $48.92 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 19,646 shares |

| Shares Outstanding: 723.58 (millions) |

| Market Capitalization: $35,396.96 (millions) |

| Beta: 0.34 |

| 52 Week High: $55.40 |

| 52 Week Low: $42.64 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.93% |

5.57% |

| 12 Week |

0.57% |

-3.80% |

| Year To Date |

-6.05% |

-4.66% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jean-Jacques Henchoz - Chief Executive Officer and Chairman

Clemens Jungsthofel - Chief Financial Officer

Silke Sehm - Director

Sven Althoff - Director

Sharon Ooi - Director

|

|

Peer Information

Hannover Ruck SE (EWB)

Hannover Ruck SE (RYAN)

Hannover Ruck SE (BRO)

Hannover Ruck SE (DMCD)

Hannover Ruck SE (AJG)

Hannover Ruck SE (HRH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-BROKERS

Sector: Finance

CUSIP: 410693105

SIC: 6399

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/12/26

|

|

Share - Related Items

Shares Outstanding: 723.58

Most Recent Split Date: 3.00 (3.00:1)

Beta: 0.34

Market Capitalization: $35,396.96 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.88% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.37 |

Indicated Annual Dividend: $0.92 |

| Current Fiscal Year EPS Consensus Estimate: $4.48 |

Payout Ratio: 0.24 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.06 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/12/26 |

|

|

|

| |