| Zacks Company Profile for iBio, Inc. (IBIO : NSDQ) |

|

|

| |

| • Company Description |

| Ibio Inc., formerly known as iBioPharma Inc., is a biopharmaceutical company that primarily focuses on developing vaccines and therapeutic proteins based upon its plant-based iBioLaunch platform technology. The Company's hydroponically grown green plants can be used for the development and manufacture of proteins applicable to a range of disease agents, such as influenza, sleeping sickness, anthrax, plague, human papillomavirus and veterinary influenza applications. IBio, Inc. is headquartered in Newark, Delaware.

Number of Employees: 20 |

|

|

| |

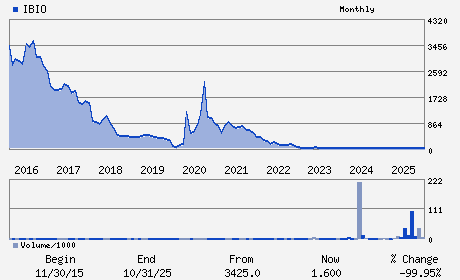

| • Price / Volume Information |

| Yesterday's Closing Price: $2.22 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,087,455 shares |

| Shares Outstanding: 34.54 (millions) |

| Market Capitalization: $76.69 (millions) |

| Beta: 1.26 |

| 52 Week High: $6.89 |

| 52 Week Low: $0.56 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.91% |

2.44% |

| 12 Week |

111.43% |

104.22% |

| Year To Date |

15.03% |

15.18% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

11750 Sorrento Valley Road Suite 200

-

San Diego,CA 92121

USA |

ph: 979-446-0027

fax: 302-356-1173 |

ir@ibioinc.com |

http://www.ibioinc.com |

|

|

| |

| • General Corporate Information |

Officers

Martin Brenner - Chief Executive Officer

William Clark - Chairman of the Board

Felipe Duran - Chief Financial Officer

David Arkowitz - Director

Antonio Parada - Director

|

|

Peer Information

iBio, Inc. (CORR.)

iBio, Inc. (RSPI)

iBio, Inc. (CGXP)

iBio, Inc. (BGEN)

iBio, Inc. (GTBP)

iBio, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 451033708

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/01/26

|

|

Share - Related Items

Shares Outstanding: 34.54

Most Recent Split Date: 11.00 (0.05:1)

Beta: 1.26

Market Capitalization: $76.69 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.08 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.44 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/01/26 |

|

|

|

| |