| Zacks Company Profile for ICL Group Ltd. (ICL : NYSE) |

|

|

| |

| • Company Description |

| ICL Group Ltd is engaged in the fertilizer and specialty chemical sectors. The company's operating segment includes Fertilizers, Industrial Products and Performance Products. Fertilizers segment is engaged in the production of standard, granular, fine red and white potash. Industrial Products segment produces flame retardants. Performance Products segment produces specialty phosphates, such as technical, food grade and electronic grade phosphoric acid, phosphate salts, food additives and wildfire safety products, as well as alumina and other chemicals. ICL Group Ltd, formerly known as Israel Chemicals Ltd, is based in Israel.

Number of Employees: 13,067 |

|

|

| |

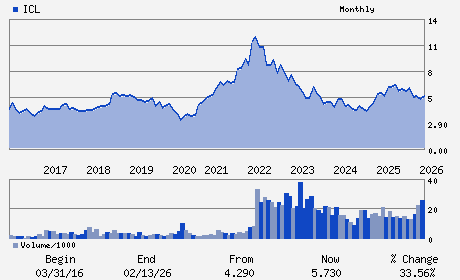

| • Price / Volume Information |

| Yesterday's Closing Price: $5.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,395,014 shares |

| Shares Outstanding: (millions) |

| Market Capitalization: $ (millions) |

| Beta: 0.98 |

| 52 Week High: $7.35 |

| 52 Week Low: $4.85 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.50% |

9.14% |

| 12 Week |

6.31% |

2.68% |

| Year To Date |

0.35% |

0.49% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Raviv Zoller - President & Chief Executive Officer

Aviram Lahav - Chief Financial Officer

Amir Meshulam - Senior Vice President

Ilana Fahima - ExecutiveVice President; Chief People Officer

Anantha N. Desikan - Executive Vice President

|

|

Peer Information

ICL Group Ltd. (ESSI.)

ICL Group Ltd. (CF)

ICL Group Ltd. (TRA)

ICL Group Ltd. (CBLUY)

ICL Group Ltd. (NTR)

ICL Group Ltd. (TNH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FERTILIZERS

Sector: Basic Materials

CUSIP: M53213100

SIC: 2870

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/18/26

|

|

Share - Related Items

Shares Outstanding:

Most Recent Split Date: (:1)

Beta: 0.98

Market Capitalization: $ (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.51% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.14 |

| Current Fiscal Year EPS Consensus Estimate: $0.50 |

Payout Ratio: 0.48 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.07 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/02/2025 - $0.04 |

| Next EPS Report Date: 02/18/26 |

|

|

|

| |