| Zacks Company Profile for Intuit Inc. (INTU : NSDQ) |

|

|

| |

| • Company Description |

| Intuit Inc. is a business and financial software company that develops and sells financial, accounting and tax preparation software and related services for small businesses, consumers and accounting professionals globally. The company has four reportable segments: Small Business and Self-Employed Group, Consumer and Strategic Partner, ProConnect and Credit Karma. Small Business and Self-Employed Group segment serves small businesses and self-employed people around the world. Intuit's offerings include QuickBooks financial and business-management online services and desktop software, payroll solutions, merchant payment-processing solutions, and financing for small businesses. Consumer segment offers DIY and assisted TurboTax income-tax preparation products and services. ProConnect serves professional accountants in the United States and Canada, who are essential to both small businesses' success and tax preparation and filing.

Number of Employees: 18,200 |

|

|

| |

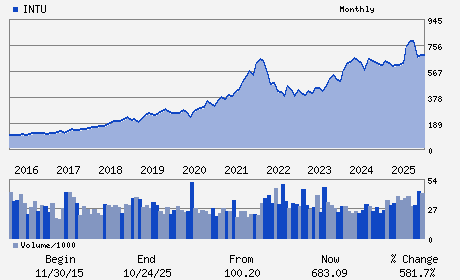

| • Price / Volume Information |

| Yesterday's Closing Price: $399.40 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,987,316 shares |

| Shares Outstanding: 278.27 (millions) |

| Market Capitalization: $111,142.62 (millions) |

| Beta: 1.24 |

| 52 Week High: $813.70 |

| 52 Week Low: $389.32 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-27.98% |

-26.84% |

| 12 Week |

-37.34% |

-40.07% |

| Year To Date |

-39.71% |

-39.81% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Sasan K. Goodarzi - Chief Executive Officer; President and Director

Suzanne Nora Johnson - Chair of the Board of Directors

Sandeep S. Aujla - Executive Vice President and Chief Financial Offic

Lauren D. Hotz - Senior Vice President and Chief Accounting Officer

Eve Burton - Director

|

|

Peer Information

Intuit Inc. (ATEA)

Intuit Inc. (BITS.)

Intuit Inc. (DCTM)

Intuit Inc. (DLVAZ)

Intuit Inc. (DOCC)

Intuit Inc. (NEON)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-SOFTWARE

Sector: Computer and Technology

CUSIP: 461202103

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: July

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 02/26/26

|

|

Share - Related Items

Shares Outstanding: 278.27

Most Recent Split Date: 7.00 (2.00:1)

Beta: 1.24

Market Capitalization: $111,142.62 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.20% |

| Current Fiscal Quarter EPS Consensus Estimate: $11.42 |

Indicated Annual Dividend: $4.80 |

| Current Fiscal Year EPS Consensus Estimate: $17.23 |

Payout Ratio: 0.30 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: 14.21% |

Last Dividend Paid: 01/09/2026 - $1.20 |

| Next EPS Report Date: 02/26/26 |

|

|

|

| |