| Zacks Company Profile for iRhythm Holdings, Inc. (IRTC : NSDQ) |

|

|

| |

| • Company Description |

| IRHYTHM HLDGS is a digital health care company which creates trusted solutions that detect, predict and prevent disease. IRHYTHM HLDGS, formerly known as iRhythm Technologies Inc., is based in SAN FRANCISCO.

Number of Employees: 2,000 |

|

|

| |

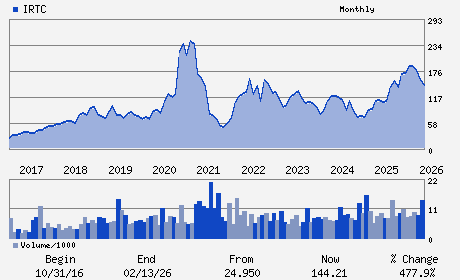

| • Price / Volume Information |

| Yesterday's Closing Price: $144.21 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 608,536 shares |

| Shares Outstanding: 32.22 (millions) |

| Market Capitalization: $4,646.32 (millions) |

| Beta: 1.06 |

| 52 Week High: $212.00 |

| 52 Week Low: $92.52 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.73% |

-12.42% |

| 12 Week |

-18.90% |

-21.67% |

| Year To Date |

-18.73% |

-18.62% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Quentin S. Blackford - President and Chief Executive Officer

Abhijit Y. Talwalkar - Chairman

Daniel Wilson - Chief Financial Officer

Marc Rosenbaum - Chief Accounting Officer

Bruce G. Bodaken - Director

|

|

Peer Information

iRhythm Holdings, Inc. (HLIS)

iRhythm Holdings, Inc. (AZTA)

iRhythm Holdings, Inc. (APYI)

iRhythm Holdings, Inc. (RNVA)

iRhythm Holdings, Inc. (HMSY)

iRhythm Holdings, Inc. (LRSI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MEDICAL INFO SYS

Sector: Medical

CUSIP: 450056106

SIC: 3841

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/19/26

|

|

Share - Related Items

Shares Outstanding: 32.22

Most Recent Split Date: (:1)

Beta: 1.06

Market Capitalization: $4,646.32 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.46 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.43 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 35.16% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/19/26 |

|

|

|

| |