| Zacks Company Profile for McCormick & Company, Incorporated (MKC : NYSE) |

|

|

| |

| • Company Description |

| McCormick & Company, Inc. is a leading manufacturer, marketer and distributor of spices, seasonings, specialty foods and flavors to the entire food industry across the entire globe. McCormick conducts its business through two segments namely Consumer unit and Flavor Solutions unit. The Consumer Business segment provides spices, herbs, extracts, seasoning blends, sauces, marinades, and specialty foods to the consumer food market. This segment primarily caters to retail outlets like grocery, mass merchandise, warehouse clubs and discount and drug stores among others. The division markets its products under brand names like McCormick, Lawry's, Zatarain's, Thai Kitchen, Simply Asia and Club House in the U.S.; and Ducros, Vahine, Schwartz and Kamis in Europe; and the Middle East and Africa (EMEA). The Flavor Solutions segment sells seasoning blends, natural spices and herbs, wet flavors, coating systems, and compound flavors to food manufacturers and food service customers.

Number of Employees: 14,100 |

|

|

| |

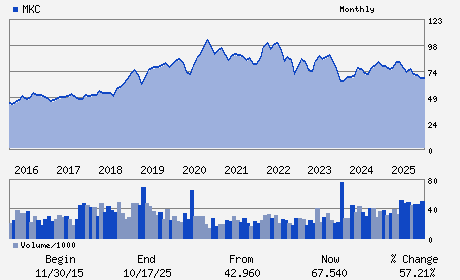

| • Price / Volume Information |

| Yesterday's Closing Price: $71.49 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,919,892 shares |

| Shares Outstanding: 268.44 (millions) |

| Market Capitalization: $19,190.65 (millions) |

| Beta: 0.61 |

| 52 Week High: $86.24 |

| 52 Week Low: $59.62 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.64% |

8.26% |

| 12 Week |

4.89% |

1.31% |

| Year To Date |

4.96% |

5.11% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Brendan M. Foley - Chairman; President & Chief Executive Officer

Marcos M. Gabriel - Executive Vice President & Chief Financial Officer

Gregory P. Repas - Vice President & Controller Principal Accounting O

Anne L. Bramman - Director

Michael A. Conway - Director

|

|

Peer Information

McCormick & Company, Incorporated (CDSCY)

McCormick & Company, Incorporated (HDNHY)

McCormick & Company, Incorporated (CPB)

McCormick & Company, Incorporated (AMNF)

McCormick & Company, Incorporated (GMFIY)

McCormick & Company, Incorporated (BRID)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FOOD-MISC/DIVERSIFIED

Sector: Consumer Staples

CUSIP: 579780206

SIC: 2090

|

|

Fiscal Year

Fiscal Year End: November

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 03/24/26

|

|

Share - Related Items

Shares Outstanding: 268.44

Most Recent Split Date: 12.00 (2.00:1)

Beta: 0.61

Market Capitalization: $19,190.65 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.69% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.63 |

Indicated Annual Dividend: $1.92 |

| Current Fiscal Year EPS Consensus Estimate: $3.10 |

Payout Ratio: 0.60 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.04 |

| Estmated Long-Term EPS Growth Rate: 5.05% |

Last Dividend Paid: 12/29/2025 - $0.48 |

| Next EPS Report Date: 03/24/26 |

|

|

|

| |