| Zacks Company Profile for Modine Manufacturing Company (MOD : NYSE) |

|

|

| |

| • Company Description |

| Modine operates primarily in a single industry consisting of the manufacture and sale of heat transfer equipment. This includes heat exchangers for cooling all types of engines, transmissions, auxiliary hydraulic equipment, air conditioning components used in cars, trucks, farm and construction machinery and equipment, and heating and cooling equipment for residential and commercial building HVAC (heating, ventilating, air conditioning and refrigeration equipment).

Number of Employees: 11,300 |

|

|

| |

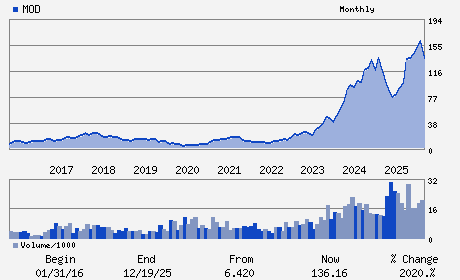

| • Price / Volume Information |

| Yesterday's Closing Price: $216.50 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,659,157 shares |

| Shares Outstanding: 52.73 (millions) |

| Market Capitalization: $11,416.26 (millions) |

| Beta: 1.71 |

| 52 Week High: $235.02 |

| 52 Week Low: $64.79 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

64.19% |

66.79% |

| 12 Week |

55.74% |

48.97% |

| Year To Date |

62.16% |

61.67% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Neil D. Brinker - Chief Executive Officer;President and Director

Marsha C. Williams - Chairperson; Board of Directors

Michael B. Lucareli - Executive Vice President; Chief Financial Officer

Eric D. Ashleman - Director

Mark Bendza - Director

|

|

Peer Information

Modine Manufacturing Company (M.BUD)

Modine Manufacturing Company (DCNAQ)

Modine Manufacturing Company (CGUL)

Modine Manufacturing Company (DAN)

Modine Manufacturing Company (CTTAY)

Modine Manufacturing Company (M.DEC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AUTO/TRUCK-ORIG

Sector: Auto/Tires/Trucks

CUSIP: 607828100

SIC: 3714

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/19/26

|

|

Share - Related Items

Shares Outstanding: 52.73

Most Recent Split Date: 2.00 (2.00:1)

Beta: 1.71

Market Capitalization: $11,416.26 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.50 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $4.81 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 34.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/19/26 |

|

|

|

| |