| Zacks Company Profile for M?nchener R?ckversicherungs-Gesellschaft (MURGY : OTC) |

|

|

| |

| • Company Description |

| M?nchener R?ckversicherungs-Gesellschaft is engaged in the insurance and reinsurance businesses worldwide. The segments that form the basis of its integrated business model are Reinsurance, Primary insurance and Munich Health. The company's reinsurance products include casualty reinsurance, property reinsurance, marine reinsurance and special lines reinsurance along with life and health reinsurance. Its primary insurance segment offers its clients a broad range of products of insurances for private, commercial and industrial needs. The Company provides life and property insurance along with health insurance, legal expenses insurance and travel insurance. Munich Health brand combines its global healthcare knowledge in primary insurance and reinsurance. M?nchener R?ckversicherungs-Gesellschaft is headquartered in Munich, Germany.

Number of Employees: 42,838 |

|

|

| |

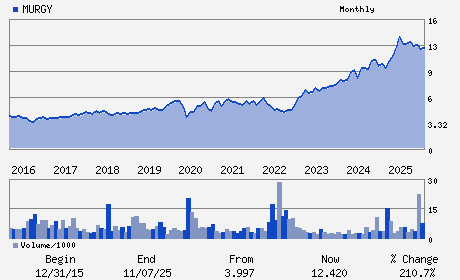

| • Price / Volume Information |

| Yesterday's Closing Price: $12.63 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 559,595 shares |

| Shares Outstanding: 6,480.29 (millions) |

| Market Capitalization: $81,846.02 (millions) |

| Beta: 0.49 |

| 52 Week High: $14.41 |

| 52 Week Low: $10.66 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.44% |

5.01% |

| 12 Week |

2.77% |

-0.74% |

| Year To Date |

-4.25% |

-4.11% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Koniginstrasse 107

-

Munich,2M 80802

DEU |

ph: 49-89-3891-3910

fax: 49-89-3891-9888 |

ir@munichre.com |

http://www.munichre.com |

|

|

| |

| • General Corporate Information |

Officers

Nikolaus von Bomhard - Chairman

Anne Horstmann - Vice Chairman

Christoph Jurecka - Chief Financial Officer

Stefan Golling - Director

Michael Kerner - Director

|

|

Peer Information

M?nchener R?ckversicherungs-Gesellschaft (RDN)

M?nchener R?ckversicherungs-Gesellschaft (AIG)

M?nchener R?ckversicherungs-Gesellschaft (ACGI)

M?nchener R?ckversicherungs-Gesellschaft (TXSC)

M?nchener R?ckversicherungs-Gesellschaft (PTVCB)

M?nchener R?ckversicherungs-Gesellschaft (PTVCA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-MULTI LINE

Sector: Finance

CUSIP: 626188106

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/25/26

|

|

Share - Related Items

Shares Outstanding: 6,480.29

Most Recent Split Date: 10.00 (5.00:1)

Beta: 0.49

Market Capitalization: $81,846.02 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.08% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.26 |

| Current Fiscal Year EPS Consensus Estimate: $1.18 |

Payout Ratio: 0.15 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: -0.15 |

| Estmated Long-Term EPS Growth Rate: 7.82% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/25/26 |

|

|

|

| |