| Zacks Company Profile for Newmont Corporation (NEM : NYSE) |

|

|

| |

| • Company Description |

| Newmont Corp. is one of the world's largest producers of gold with several active mines in Nevada, Peru, Australia and Ghana. Newmont's operating segments are N. America, S. America, Australia and Africa. The N. America segment has operations in Mexico, Canada and in the U.S. The S. America segment is represented by operations in Suriname, Peru, Argentina and Dominican Republic. The Australia segment consists of Boddington and Tanami. Newmont fully owns and operates the Tanami mine. The Africa segment operations are represented by the fully-owned Ahafo and Akyem mines in Ghana.

Number of Employees: 22,200 |

|

|

| |

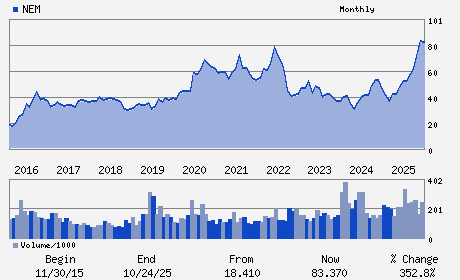

| • Price / Volume Information |

| Yesterday's Closing Price: $125.80 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 10,562,840 shares |

| Shares Outstanding: 1,091.26 (millions) |

| Market Capitalization: $137,280.88 (millions) |

| Beta: 0.40 |

| 52 Week High: $134.88 |

| 52 Week Low: $41.23 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

10.23% |

11.91% |

| 12 Week |

50.68% |

45.54% |

| Year To Date |

25.99% |

26.16% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Thomas R. Palmer - President; Chief Executive Officer and Director

Gregory H. Boyce - Non-Executive Chairman

Natascha Viljoen - Executive Vice President and Chief Operating Offic

Karyn F. Ovelmen - Executive Vice President and Chief Financial Offic

Brian C. Tabolt - Senior Vice President; Global Finance and Chief Ac

|

|

Peer Information

Newmont Corporation (MDWCQ)

Newmont Corporation (JABI)

Newmont Corporation (DRD)

Newmont Corporation (SDMCF)

Newmont Corporation (BENGF)

Newmont Corporation (GBGLF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MINING -GOLD

Sector: Basic Materials

CUSIP: 651639106

SIC: 1040

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/19/26

|

|

Share - Related Items

Shares Outstanding: 1,091.26

Most Recent Split Date: 4.00 (1.25:1)

Beta: 0.40

Market Capitalization: $137,280.88 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.79% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.71 |

Indicated Annual Dividend: $1.00 |

| Current Fiscal Year EPS Consensus Estimate: $8.13 |

Payout Ratio: 0.17 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: -0.51 |

| Estmated Long-Term EPS Growth Rate: 14.69% |

Last Dividend Paid: 11/26/2025 - $0.25 |

| Next EPS Report Date: 02/19/26 |

|

|

|

| |