| Zacks Company Profile for NL Industries, Inc. (NL : NYSE) |

|

|

| |

| • Company Description |

| NL INDUSTRIES, INC. conducts its operations through its two wholly-owned subsidiaries, Kronos, Inc. and Rheox, Inc. Kronos, Inc. produces titanium dioxide pigments, chemical products used for imparting whiteness, brightness and opacity to a wide range of products, including paints, paper, plastics, fibers and ceramics. Rheox, Inc. produces rheological additives that control the flow and leveling characteristics for a variety of products, including paints, inks, lubricants, sealants, adhesives and cosmetics.

Number of Employees: 510 |

|

|

| |

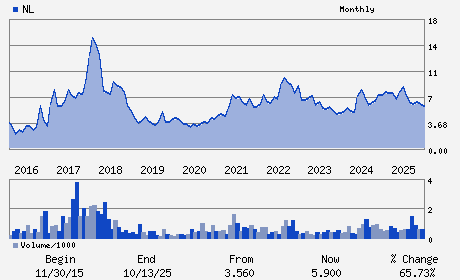

| • Price / Volume Information |

| Yesterday's Closing Price: $6.30 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 48,688 shares |

| Shares Outstanding: 48.86 (millions) |

| Market Capitalization: $307.83 (millions) |

| Beta: 0.27 |

| 52 Week High: $9.27 |

| 52 Week Low: $5.04 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.60% |

8.22% |

| 12 Week |

13.51% |

9.64% |

| Year To Date |

15.17% |

15.33% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

5430 LBJ Freeway Suite 1700

-

DALLAS,TX 75240

USA |

ph: 972-233-1700

fax: 281-423-3216 |

None |

http://www.nl-ind.com |

|

|

| |

| • General Corporate Information |

Officers

Courtney J. Riley - Chief Executive Officer and President

Loretta J. Feehan - Chairman

Michael S. Simmons - Vice Chairman

Amy Allbach Samford - Chief Financial Officer and Executive Vice Preside

Amy E. Ruf - Vice President; Controller and Principal Accountin

|

|

Peer Information

NL Industries, Inc. (CSBHY)

NL Industries, Inc. (ARWM)

NL Industries, Inc. (FUL)

NL Industries, Inc. (IAX)

NL Industries, Inc. (AVD)

NL Industries, Inc. (ASH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-SPECIALTY

Sector: Basic Materials

CUSIP: 629156407

SIC: 2810

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/09/26

|

|

Share - Related Items

Shares Outstanding: 48.86

Most Recent Split Date: 6.00 (1.01:1)

Beta: 0.27

Market Capitalization: $307.83 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 5.71% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.36 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 1.80 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 1.24 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 11/21/2025 - $0.09 |

| Next EPS Report Date: 03/09/26 |

|

|

|

| |