| Zacks Company Profile for NN, Inc. (NNBR : NSDQ) |

|

|

| |

| • Company Description |

| NN Inc., a global diversified industrial company, combines advanced engineering and production capabilities with in-depth materials science expertise to design and manufacture high-precision components and assemblies for a variety of markets on a global basis. Headquartered in Charlotte, North Carolina, NN has facilities in North America, Europe, South America, and Asia.

Number of Employees: 2,900 |

|

|

| |

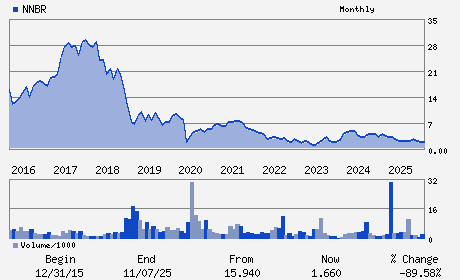

| • Price / Volume Information |

| Yesterday's Closing Price: $1.72 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 369,272 shares |

| Shares Outstanding: 50.20 (millions) |

| Market Capitalization: $86.34 (millions) |

| Beta: 2.30 |

| 52 Week High: $3.52 |

| 52 Week Low: $1.10 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

18.62% |

20.42% |

| 12 Week |

37.60% |

32.91% |

| Year To Date |

34.38% |

34.56% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

6210 Ardrey Kell Road Suite 120

-

Charlotte,NC 28277

USA |

ph: 980-264-4300

fax: 423-743-2670 |

nnbr@alpha-ir.com |

http://www.nninc.com |

|

|

| |

| • General Corporate Information |

Officers

Harold C. Bevis - President; Chief Executive Officer and Director

Jeri J. Harman - Non-Executive Chairman; Director

Christopher H. Bohnert - Senior Vice President and Chief Financial Officer

Raynard D. Benvenuti - Director

Christina E. Carroll - Director

|

|

Peer Information

NN, Inc. (DCS.)

NN, Inc. (CPTD)

NN, Inc. (HIHO)

NN, Inc. (T.GNA)

NN, Inc. (HTLJ)

NN, Inc. (CENX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: METAL PROC&FABR

Sector: Industrial Products

CUSIP: 629337106

SIC: 3540

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/04/26

|

|

Share - Related Items

Shares Outstanding: 50.20

Most Recent Split Date: 12.00 (1.50:1)

Beta: 2.30

Market Capitalization: $86.34 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.01 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.14 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 45.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/04/26 |

|

|

|

| |