| Zacks Company Profile for ONEOK, Inc. (OKE : NYSE) |

|

|

| |

| • Company Description |

| ONEOK Inc. is an energy company engaged in natural gas and natural gas liquids (NGL) businesses. Its operations are divided into 3 reportable business segments: Natural Gas Gathering & Processing, Natural Gas Liquids and Natural Gas Pipelines. The Natural Gas Gathering & Processing segment provides nondiscretionary services to producers that include gathering and processing of natural gas produced from crude oil and natural gas wells. This segment gathers and processes natural gas in the Mid-Continent region. The Natural Gas Liquids segment owns and operates facilities primarily in Oklahoma, Kansas, Texas, New Mexico and the Rocky Mountain region where it provides nondiscretionary services to producers of NGLs. The Natural Gas Pipelines segment owns and operates regulated natural gas transmission pipelines and natural gas storage facilities. Other and eliminations is a non-operating segment consisting of the operating and leasing operations of the company's headquarters building and related parking facility.

Number of Employees: 5,177 |

|

|

| |

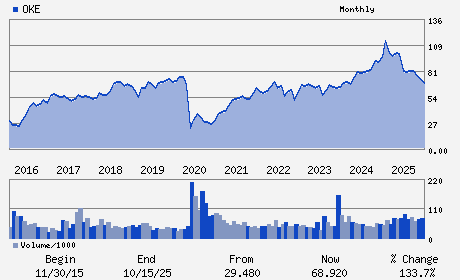

| • Price / Volume Information |

| Yesterday's Closing Price: $86.11 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,696,689 shares |

| Shares Outstanding: 629.23 (millions) |

| Market Capitalization: $54,183.13 (millions) |

| Beta: 0.96 |

| 52 Week High: $103.64 |

| 52 Week Low: $64.02 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

15.74% |

17.50% |

| 12 Week |

22.09% |

17.92% |

| Year To Date |

17.16% |

17.32% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Pierce H. Norton II - Chief Executive Officer and President

Julie H. Edwards - Chairman

Walter S. Hulse III - Chief Financial Officer and Treasurer

Mary M. Spears - Senior Vice President

Brian L. Derksen - Director

|

|

Peer Information

ONEOK, Inc. (KMP)

ONEOK, Inc. (OMP)

ONEOK, Inc. (WMZ)

ONEOK, Inc. (BPL)

ONEOK, Inc. (PAA)

ONEOK, Inc. (EEP)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Oil/Gas Prod Pipeline MLP

Sector: Oils/Energy

CUSIP: 682680103

SIC: 4923

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/23/26

|

|

Share - Related Items

Shares Outstanding: 629.23

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.96

Market Capitalization: $54,183.13 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.97% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.34 |

Indicated Annual Dividend: $4.28 |

| Current Fiscal Year EPS Consensus Estimate: $5.76 |

Payout Ratio: 0.76 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: -0.20 |

| Estmated Long-Term EPS Growth Rate: 3.06% |

Last Dividend Paid: 02/02/2026 - $1.07 |

| Next EPS Report Date: 02/23/26 |

|

|

|

| |