| Zacks Company Profile for Belpointe PREP, LLC (OZ : AMEX) |

|

|

| |

| • Company Description |

| Belpointe PREP intends to acquire, develop or redevelop and manage commercial real estate assets located principally in United States and its territories, including, but not limited to, real estate-related assets, such as commercial real estate loans and mortgages and debt and equity securities issued by other real estate-related companies, as well as making private equity acquisitions and investments. Belpointe PREP is based in GREENWICH, Conn.

Number of Employees: |

|

|

| |

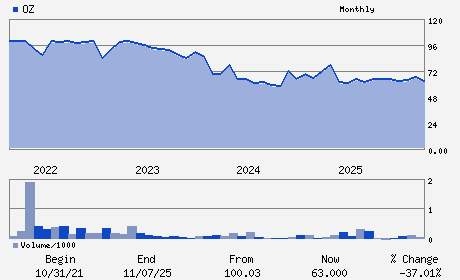

| • Price / Volume Information |

| Yesterday's Closing Price: $50.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 7,912 shares |

| Shares Outstanding: 3.89 (millions) |

| Market Capitalization: $195.34 (millions) |

| Beta: 0.39 |

| 52 Week High: $82.89 |

| 52 Week Low: $49.58 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.47% |

-6.06% |

| 12 Week |

-17.70% |

-20.51% |

| Year To Date |

-22.81% |

-22.70% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Brandon E. Lacoff - Chairman of the Board and Chief Executive Officer

Martin Lacoff - Director

Dean Drulias - Director

Timothy Oberweger - Director

Shawn Orser - Director

|

|

Peer Information

Belpointe PREP, LLC (AVHI.)

Belpointe PREP, LLC (HNGKY)

Belpointe PREP, LLC (INTG)

Belpointe PREP, LLC (FCAR)

Belpointe PREP, LLC (AIHC)

Belpointe PREP, LLC (CDGD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REAL ESTATE DEV

Sector: Finance

CUSIP: 080694102

SIC: 6500

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/30/26

|

|

Share - Related Items

Shares Outstanding: 3.89

Most Recent Split Date: (:1)

Beta: 0.39

Market Capitalization: $195.34 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/30/26 |

|

|

|

| |