| Zacks Company Profile for Porch Group, Inc. (PRCH : NSDQ) |

|

|

| |

| • Company Description |

| Porch Group Inc. provides the vertical software platform for the home. It offer software and services to home services companies such as home inspectors, moving companies, real estate agencies, utility companies and warranty companies. It also provides a moving concierge service to homebuyers, includes insurance, moving, security, TV/internet and home repair. Porch Group Inc., formerly known as PropTech Acquisition Corporation, is based in Seattle.

Number of Employees: 733 |

|

|

| |

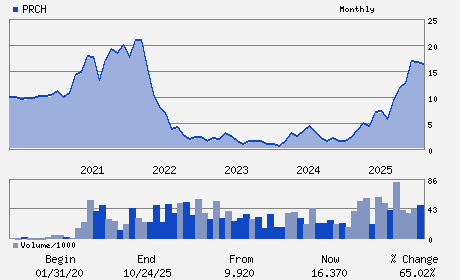

| • Price / Volume Information |

| Yesterday's Closing Price: $8.36 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,926,255 shares |

| Shares Outstanding: 123.68 (millions) |

| Market Capitalization: $1,034.00 (millions) |

| Beta: 3.08 |

| 52 Week High: $19.44 |

| 52 Week Low: $3.72 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-8.03% |

-6.57% |

| 12 Week |

-8.23% |

-12.22% |

| Year To Date |

-8.43% |

-6.29% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

411 1st Avenue S. Suite 501

-

Seattle,WA 98104

USA |

ph: 855-767-2400

fax: - |

ir@porch.com |

http://www.porchgroup.com |

|

|

| |

| • General Corporate Information |

Officers

Matthew Ehrlichman - Chief Executive Officer

Shawn Tabak - Chief Financial Officer

Sean Kell - Director

Rachel Lam - Director

Alan Pickerill - Director

|

|

Peer Information

Porch Group, Inc. (ADP)

Porch Group, Inc. (CWLD)

Porch Group, Inc. (CYBA.)

Porch Group, Inc. (ZVLO)

Porch Group, Inc. (AZPN)

Porch Group, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 733245104

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 123.68

Most Recent Split Date: (:1)

Beta: 3.08

Market Capitalization: $1,034.00 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.10 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.04 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |