| Zacks Company Profile for Primoris Services Corporation (PRIM : NYSE) |

|

|

| |

| • Company Description |

| Primoris Services Corporation, through various subsidiaries, operates as one of the largest specialty contractors and infrastructure companies in the United States. The Company provides a wide range of construction, fabrication, maintenance, replacement, water and wastewater, and engineering services to major public utilities, petrochemical companies, energy companies, municipalities, and other customers. It operates through three segments: East Construction Services; West Construction Services; and Engineering. Primoris Services Corporation is headquartered in Dallas, Texas.

Number of Employees: 15,716 |

|

|

| |

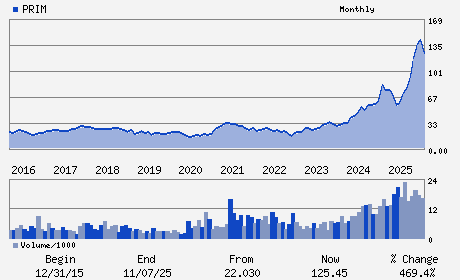

| • Price / Volume Information |

| Yesterday's Closing Price: $166.53 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 675,648 shares |

| Shares Outstanding: 54.03 (millions) |

| Market Capitalization: $8,997.95 (millions) |

| Beta: 1.37 |

| 52 Week High: $174.43 |

| 52 Week Low: $49.10 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.89% |

14.68% |

| 12 Week |

42.66% |

36.46% |

| Year To Date |

34.15% |

31.91% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2300 N. Field Street Suite1900

-

Dallas,TX 75201

USA |

ph: 214-740-5600

fax: - |

bholcomb@prim.com |

http://www.prim.com |

|

|

| |

| • General Corporate Information |

Officers

Thomas E. McCormick - President; Chief Executive Officer and Director

David L. King - Chairman of the Board of Directors

Kenneth M. Dodgen - Executive Vice President; Chief Financial Officer

Travis L. Stricker - Senior Vice President; Chief Accounting Officer

Michael E. Ching - Director

|

|

Peer Information

Primoris Services Corporation (DBCOQ)

Primoris Services Corporation (PHOE)

Primoris Services Corporation (UNTKQ)

Primoris Services Corporation (MTZ)

Primoris Services Corporation (CBI)

Primoris Services Corporation (GMDBY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG-HEAVY CNST

Sector: Construction

CUSIP: 74164F103

SIC: 1623

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/23/26

|

|

Share - Related Items

Shares Outstanding: 54.03

Most Recent Split Date: (:1)

Beta: 1.37

Market Capitalization: $8,997.95 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.19% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.79 |

Indicated Annual Dividend: $0.32 |

| Current Fiscal Year EPS Consensus Estimate: $5.62 |

Payout Ratio: 0.06 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: 13.00% |

Last Dividend Paid: 12/31/2025 - $0.08 |

| Next EPS Report Date: 02/23/26 |

|

|

|

| |