| Zacks Company Profile for Proto Labs, Inc. (PRLB : NYSE) |

|

|

| |

| • Company Description |

| Proto Labs, Inc. is an online and technology-enabled quick-turn manufacturer of custom parts for prototyping and short-run production. It produces CNC machined and injection molded plastic parts. Proto Labs targets their services to product developers who use three-dimensional computer-aided design to develop products across a diverse range of end-markets. The Company has locations in the United States, the United Kingdom, Germany, Japan, Italy, France, and Spain. Proto Labs, Inc. is headquartered in Maple Plain, Minnesota.

Number of Employees: 2,357 |

|

|

| |

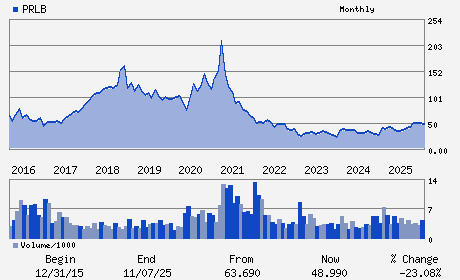

| • Price / Volume Information |

| Yesterday's Closing Price: $67.52 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 227,226 shares |

| Shares Outstanding: 23.68 (millions) |

| Market Capitalization: $1,598.81 (millions) |

| Beta: 1.24 |

| 52 Week High: $68.91 |

| 52 Week Low: $29.59 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

22.76% |

24.71% |

| 12 Week |

44.24% |

37.97% |

| Year To Date |

33.47% |

31.59% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Robert Bodor - President and Chief Executive Officer

Rainer Gawlick - Chairman of the Board of Directors

Daniel Schumacher - Chief Financial Officer

Archie C. Black - Director

Sujeet Chand - Director

|

|

Peer Information

Proto Labs, Inc. (AETCQ)

Proto Labs, Inc. (WFF)

Proto Labs, Inc. (CPTI.)

Proto Labs, Inc. (SUMX)

Proto Labs, Inc. (LMS)

Proto Labs, Inc. (CMT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RUBBER&PLASTICS

Sector: Industrial Products

CUSIP: 743713109

SIC: 3440

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/01/26

|

|

Share - Related Items

Shares Outstanding: 23.68

Most Recent Split Date: (:1)

Beta: 1.24

Market Capitalization: $1,598.81 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.26 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.22 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/01/26 |

|

|

|

| |