| Zacks Company Profile for CarParts.com, Inc. (PRTS : NSDQ) |

|

|

| |

| • Company Description |

| CarParts.com Inc. offer e-commerce automotive aftermarket, providing collision, engine and performance parts and accessories. CarParts.com Inc., formerly known as U.S. Auto Parts Network Inc., is headquartered in Torrance, California.

Number of Employees: 1,466 |

|

|

| |

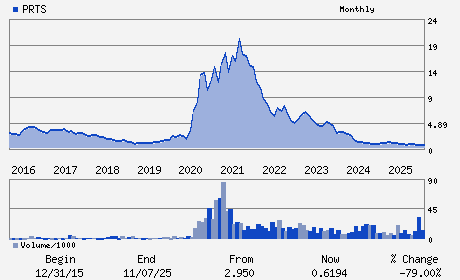

| • Price / Volume Information |

| Yesterday's Closing Price: $0.70 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 737,177 shares |

| Shares Outstanding: 69.76 (millions) |

| Market Capitalization: $48.83 (millions) |

| Beta: 0.94 |

| 52 Week High: $1.36 |

| 52 Week Low: $0.37 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

32.58% |

34.68% |

| 12 Week |

59.38% |

52.45% |

| Year To Date |

40.00% |

29.26% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2050 W. 190TH STREET SUITE 400

-

TORRANCE,CA 90504

USA |

ph: 424-702-1455

fax: 310-632-1681 |

ir@carparts.com |

http://www.carparts.com |

|

|

| |

| • General Corporate Information |

Officers

David Meniane - Chief Executive Officer and Director

Warren B. Phelps III - Chairman

Ryan Lockwood - Chief Financial Officer

Jay K. Greyson - Director

Jim Barnes - Director

|

|

Peer Information

CarParts.com, Inc. (M.BUD)

CarParts.com, Inc. (DCNAQ)

CarParts.com, Inc. (CGUL)

CarParts.com, Inc. (DAN)

CarParts.com, Inc. (CTTAY)

CarParts.com, Inc. (M.DEC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AUTO/TRUCK-ORIG

Sector: Auto/Tires/Trucks

CUSIP: 14427M107

SIC: 5531

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 69.76

Most Recent Split Date: (:1)

Beta: 0.94

Market Capitalization: $48.83 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |