| Zacks Company Profile for Prudential Financial, Inc. (PRU : NYSE) |

|

|

| |

| • Company Description |

| Prudential Financial Inc., through its subsidiaries and affiliates, is a financial services leader offers an array of financial products and services including life insurance, annuities, retirement-related services, mutual funds, investment management and real estate services. These are offered to individual and institutional customers across United States, Asia, Europe and Latin America.

Number of Employees: 38,196 |

|

|

| |

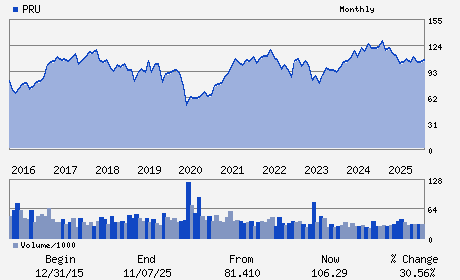

| • Price / Volume Information |

| Yesterday's Closing Price: $104.61 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,574,065 shares |

| Shares Outstanding: 350.00 (millions) |

| Market Capitalization: $36,613.50 (millions) |

| Beta: 0.97 |

| 52 Week High: $119.76 |

| 52 Week Low: $90.38 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-10.15% |

-8.73% |

| 12 Week |

0.47% |

-3.90% |

| Year To Date |

-7.33% |

-7.56% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Andrew F. Sullivan - Chief Executive Officer; President and Director

Charles F. Lowrey - Chairman and Director

Yanela C. Frias - Chief Financial Officer and Executive Vice Preside

Robert E. Boyle - Senior Vice President and Controller

Gilbert F. Casellas - Director

|

|

Peer Information

Prudential Financial, Inc. (RDN)

Prudential Financial, Inc. (AIG)

Prudential Financial, Inc. (ACGI)

Prudential Financial, Inc. (TXSC)

Prudential Financial, Inc. (PTVCB)

Prudential Financial, Inc. (PTVCA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-MULTI LINE

Sector: Finance

CUSIP: 744320102

SIC: 6311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 350.00

Most Recent Split Date: (:1)

Beta: 0.97

Market Capitalization: $36,613.50 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 5.16% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.42 |

Indicated Annual Dividend: $5.40 |

| Current Fiscal Year EPS Consensus Estimate: $14.70 |

Payout Ratio: 0.37 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: 5.97% |

Last Dividend Paid: 11/18/2025 - $1.35 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |