| Zacks Company Profile for StandardAero, Inc. (SARO : NYSE) |

|

|

| |

| • Company Description |

| StandardAero Inc. is a pure-play provider of aerospace engine aftermarket services for fixed and rotary wing aircraft, serving the commercial, military and business aviation end markets. The company provides a comprehensive suite of critical, value-added aftermarket solutions including engine maintenance, repair and overhaul, engine component repair, on-wing and field service support, asset management and engineering solutions. StandardAero Inc. is based in SCOTTSDALE, Ariz.

Number of Employees: 7,700 |

|

|

| |

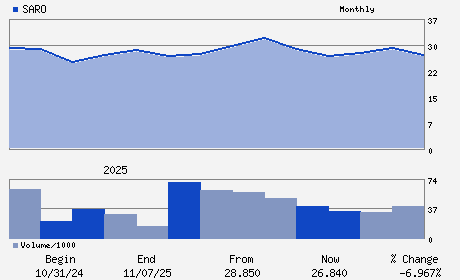

| • Price / Volume Information |

| Yesterday's Closing Price: $30.57 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,189,527 shares |

| Shares Outstanding: 334.47 (millions) |

| Market Capitalization: $10,224.70 (millions) |

| Beta: 1.04 |

| 52 Week High: $34.48 |

| 52 Week Low: $21.31 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.88% |

-4.45% |

| 12 Week |

23.57% |

19.35% |

| Year To Date |

6.59% |

6.74% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Russell Ford - Chief Executive Officer and Director

Daniel Satterfield - Chief Financial Officer

Douglas Brandely - Director

Peter J. Clare - Director

Ian Fujiyama - Director

|

|

Peer Information

StandardAero, Inc. (BA)

StandardAero, Inc. (HOVR)

StandardAero, Inc. (HWM)

StandardAero, Inc. (LMT)

StandardAero, Inc. (TOD)

StandardAero, Inc. (TXT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AEROSP/DEFENSE

Sector: Aerospace

CUSIP: 85423L103

SIC: 3724

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/25/26

|

|

Share - Related Items

Shares Outstanding: 334.47

Most Recent Split Date: (:1)

Beta: 1.04

Market Capitalization: $10,224.70 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.14 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.17 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/25/26 |

|

|

|

| |