| Zacks Company Profile for Sinclair, Inc. (SBGI : NSDQ) |

|

|

| |

| • Company Description |

| Sinclair Inc. is a diversified media company and a provider of local news and sports. The Company owns, operates and/or provides services to television stations. Sinclair Inc., formerly known as Sinclair Broadcast Group Inc., is based in HUNT VALLEY, Md.

Number of Employees: 7,200 |

|

|

| |

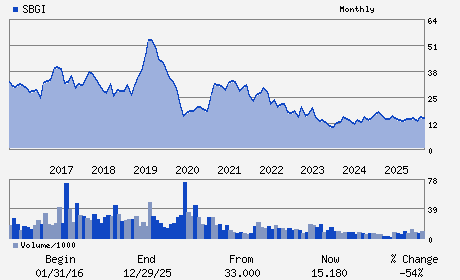

| • Price / Volume Information |

| Yesterday's Closing Price: $14.96 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 348,708 shares |

| Shares Outstanding: 69.68 (millions) |

| Market Capitalization: $1,042.47 (millions) |

| Beta: 0.96 |

| 52 Week High: $17.88 |

| 52 Week Low: $11.89 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.90% |

-0.41% |

| 12 Week |

-4.41% |

-7.67% |

| Year To Date |

-2.22% |

-2.09% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

10706 BEAVER DAM ROAD

-

HUNT VALLEY,MD 21030

USA |

ph: 410-568-1500

fax: 410-568-1533 |

ir@sbgtv.com |

http://www.sbgi.net |

|

|

| |

| • General Corporate Information |

Officers

Christopher S. Ripley - President and Chief Executive Officer

David D. Smith - Chairman of the Board and Executive Chairman

Lucy A. Rutishauser - Executive Vice President and Chief Financial Offic

David R. Bochenek - Senior Vice President and Chief Accounting Officer

Frederick G. Smith - Director

|

|

Peer Information

Sinclair, Inc. (PSO)

Sinclair, Inc. (LSXMK)

Sinclair, Inc. (ACCS)

Sinclair, Inc. (TKVR)

Sinclair, Inc. (TST)

Sinclair, Inc. (PARAA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MEDIA CONGLOM

Sector: Consumer Discretionary

CUSIP: 829242106

SIC: 4833

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/25/26

|

|

Share - Related Items

Shares Outstanding: 69.68

Most Recent Split Date: 5.00 (2.00:1)

Beta: 0.96

Market Capitalization: $1,042.47 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 6.68% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.17 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/01/2025 - $0.25 |

| Next EPS Report Date: 02/25/26 |

|

|

|

| |