| Zacks Company Profile for Trend Micro Inc. (TMICY : OTC) |

|

|

| |

| • Company Description |

| Trend Micro Incorporated is engaged in providing endpoint, messaging and Web security software and services. It develops security solutions that protects against a wide range of insidious threats and combined attacks including viruses, spam, phishing, spyware, botnets, and other Web attacks, including data-stealing malware. With Trend Micro, Smart Protection Network, the Company combines Internet-based technologies with smaller, lighter weight clients to stop threats. The Company operates a global network of datacenters combined with automated and manual threat correlation systems to provide customers with a real-time feedback loop of round-the-clock threat intelligence and protection. It helps in exchanging digital information by offering a comprehensive array of customizable solutions to enterprises, small and medium businesses, individuals, service providers and OEM partners. Trend Micro Incorporated is headquartered in Tokyo, Japan.

Number of Employees: 6,869 |

|

|

| |

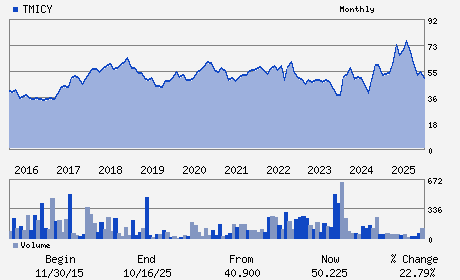

| • Price / Volume Information |

| Yesterday's Closing Price: $36.16 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 54,684 shares |

| Shares Outstanding: 140.90 (millions) |

| Market Capitalization: $5,095.00 (millions) |

| Beta: 0.75 |

| 52 Week High: $79.99 |

| 52 Week Low: $35.22 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-11.19% |

-9.84% |

| 12 Week |

-29.25% |

-31.66% |

| Year To Date |

-12.30% |

-12.18% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Eva Chen - Chief Executive Officer

Chang Ming-Jang - Chairman

Kevin Simzer - Chief Operating Officer

Mahendra Negi - Chief Financial Officer

TetsuoKoga - Director

|

|

Peer Information

Trend Micro Inc. (ATEA)

Trend Micro Inc. (BITS.)

Trend Micro Inc. (DCTM)

Trend Micro Inc. (DLVAZ)

Trend Micro Inc. (DOCC)

Trend Micro Inc. (NEON)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-SOFTWARE

Sector: Computer and Technology

CUSIP: 89486M206

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/17/26

|

|

Share - Related Items

Shares Outstanding: 140.90

Most Recent Split Date: (:1)

Beta: 0.75

Market Capitalization: $5,095.00 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.63% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.95 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.53 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.83 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/17/26 |

|

|

|

| |