| Zacks Company Profile for Trex Company, Inc. (TREX : NYSE) |

|

|

| |

| • Company Description |

| Trex Company, Inc. is a manufacturer of wood-alternative decking and railing. Trex Company, Inc. is based in Winchester, United States.

Number of Employees: 1,838 |

|

|

| |

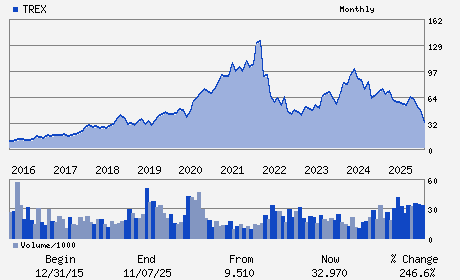

| • Price / Volume Information |

| Yesterday's Closing Price: $42.80 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,511,726 shares |

| Shares Outstanding: 107.25 (millions) |

| Market Capitalization: $4,590.50 (millions) |

| Beta: 1.58 |

| 52 Week High: $70.08 |

| 52 Week Low: $29.77 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.13% |

-0.64% |

| 12 Week |

37.84% |

33.14% |

| Year To Date |

22.01% |

22.17% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2500 Trex Way

-

WINCHESTER,VA 22601

USA |

ph: 540-542-6300

fax: 540-678-1820 |

None |

http://www.trex.com |

|

|

| |

| • General Corporate Information |

Officers

Bryan H. Fairbanks - President and Chief Executive Officer

James E. Cline - Chairman

Brenda K. Lovcik - Senior Vice President and Chief Financial Officer

Ronald W. Kaplan - Vice Chairman

Jay M. Gratz - Director

|

|

Peer Information

Trex Company, Inc. (DURX)

Trex Company, Inc. (NWGL)

Trex Company, Inc. (DEL)

Trex Company, Inc. (CRPP)

Trex Company, Inc. (POPE)

Trex Company, Inc. (BTEK.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG PRD-WOOD

Sector: Construction

CUSIP: 89531P105

SIC: 2400

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/24/26

|

|

Share - Related Items

Shares Outstanding: 107.25

Most Recent Split Date: 9.00 (2.00:1)

Beta: 1.58

Market Capitalization: $4,590.50 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.53 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.66 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/24/26 |

|

|

|

| |