| Zacks Company Profile for TELUS Corporation (TU : NYSE) |

|

|

| |

| • Company Description |

| TELUS Corporation is a leading telecom service provider. TELUS provides wireless, wireline, and Internet communications services for voice and data to businesses and consumers. TELUS achieved a strong foothold in the Canadian healthcare telecom market through its acquisition of Emergis, a business process outsourcer specializing in healthcare and financial services. strengthing industry solutions for healthcare and financial services. The acquisition of Toronto-based Fastvibe Corporation, a leading provider of innovative and superior quality web streaming solutions for businesses, has added a unique technical, event and production web management capability to the TELUS' expertise. TELUS now reports its revenues under two segments - TELUS technology solutions comprising of healthcare software and technology solutions. TELUS International is involved in the delivery of best-in-class digital solutions like content management and artificial intelligence on the back of enhanced customer experience.

Number of Employees: 106,800 |

|

|

| |

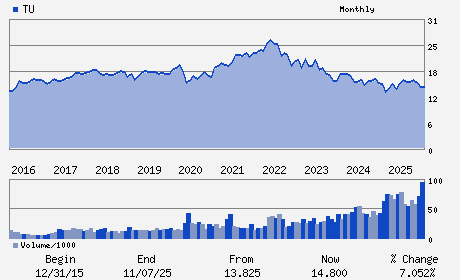

| • Price / Volume Information |

| Yesterday's Closing Price: $13.48 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,031,623 shares |

| Shares Outstanding: 1,548.00 (millions) |

| Market Capitalization: $20,867.04 (millions) |

| Beta: 0.67 |

| 52 Week High: $16.74 |

| 52 Week Low: $12.54 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.52% |

0.99% |

| 12 Week |

1.51% |

-1.96% |

| Year To Date |

2.35% |

2.49% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

510 West Georgia Street 23rd Floor

-

Vancouver,A1 V6B 0M3

CAN |

ph: 604-697-8044

fax: - |

ir@telus.com |

http://www.telus.com |

|

|

| |

| • General Corporate Information |

Officers

Darren Entwistle - Chief Executive Officer and President

Doug French - Executive Vice-president and Chief Financial Offic

Mario Mele - Senior Vice President and Treasurer

Raymond T. Chan - Director

Hazel Claxton - Director

|

|

Peer Information

TELUS Corporation (IDAI.)

TELUS Corporation (RPID.)

TELUS Corporation (ACTT.)

TELUS Corporation (CVST)

TELUS Corporation (GTTLQ)

TELUS Corporation (BCE)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Diversified Comm Services

Sector: Utilities

CUSIP: 87971M103

SIC: 4812

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/08/26

|

|

Share - Related Items

Shares Outstanding: 1,548.00

Most Recent Split Date: 3.00 (2.00:1)

Beta: 0.67

Market Capitalization: $20,867.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 8.89% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.20 |

Indicated Annual Dividend: $1.20 |

| Current Fiscal Year EPS Consensus Estimate: $0.78 |

Payout Ratio: 1.82 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.41 |

| Estmated Long-Term EPS Growth Rate: 8.82% |

Last Dividend Paid: 12/11/2025 - $0.30 |

| Next EPS Report Date: 05/08/26 |

|

|

|

| |