| Zacks Company Profile for Upbound Group, Inc. (UPBD : NSDQ) |

|

|

| |

| • Company Description |

| Upbound Group Inc. is an omni-channel platform company committed to elevating financial opportunity for technology-driven financial solutions. The Company's customer-facing operating units include brands such as Rent-A-Center(R) and Acima(R). Upbound Group Inc., formerly known as Rent-A-Center Inc., is based in PLANO, Texas.

Number of Employees: 11,970 |

|

|

| |

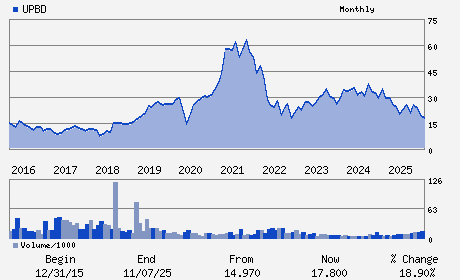

| • Price / Volume Information |

| Yesterday's Closing Price: $20.31 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 586,636 shares |

| Shares Outstanding: 57.91 (millions) |

| Market Capitalization: $1,176.06 (millions) |

| Beta: 1.88 |

| 52 Week High: $30.20 |

| 52 Week Low: $15.82 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.79% |

2.33% |

| 12 Week |

16.72% |

12.74% |

| Year To Date |

15.66% |

15.82% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Mitchell E. Fadel - Chief Executive Officer and Director

Fahmi W. Karam - Chief Financial Officer

Jeffrey J. Brown - Director

Harold Lewis - Director

Glenn P. Marino - Director

|

|

Peer Information

Upbound Group, Inc. (CAII)

Upbound Group, Inc. (KPLT)

Upbound Group, Inc. (ELRC)

Upbound Group, Inc. (PMCPE)

Upbound Group, Inc. (IAIS)

Upbound Group, Inc. (UPBD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-LEASING COS

Sector: Finance

CUSIP: 76009N100

SIC: 7359

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/19/26

|

|

Share - Related Items

Shares Outstanding: 57.91

Most Recent Split Date: 9.00 (2.50:1)

Beta: 1.88

Market Capitalization: $1,176.06 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 7.68% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.97 |

Indicated Annual Dividend: $1.56 |

| Current Fiscal Year EPS Consensus Estimate: $4.50 |

Payout Ratio: 0.37 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/17/2025 - $0.39 |

| Next EPS Report Date: 02/19/26 |

|

|

|

| |