| Zacks Company Profile for USA Compression Partners, LP (USAC : NYSE) |

|

|

| |

| • Company Description |

| USA Compression Partners, LP is one of the largest independent natural gas compression services providers across the U.S. in terms of fleet horsepower. The company primarily focuses on large-horsepower applications in a number of areas. The firm is also involved in engineering, designing, operation, service & repair of compressor units. It has a diversified customer base consisting of major oil and gas companies, large independent upstream players and midstream operators. The master limited partnership, with the Energy Transfer family, offers cash flow stability from long-term contracts from its diversified infrastructure assets. Natural gas compressors help the commodity to move from the wellhead to the end market. The compression equipment is an integral part of natural gas pipelines, helping to push the fuel from one place to another. Compression service providers supply the infrastructure needed to maintain the flow and pressure throughout the transportation chain.

Number of Employees: 854 |

|

|

| |

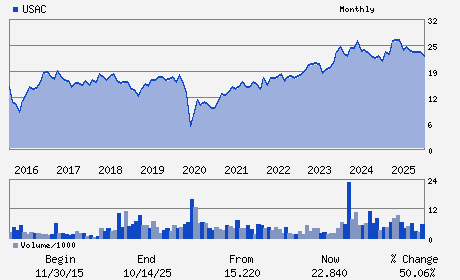

| • Price / Volume Information |

| Yesterday's Closing Price: $26.60 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 218,293 shares |

| Shares Outstanding: 122.68 (millions) |

| Market Capitalization: $3,263.42 (millions) |

| Beta: 0.23 |

| 52 Week High: $28.79 |

| 52 Week Low: $21.59 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.38% |

5.02% |

| 12 Week |

12.28% |

7.40% |

| Year To Date |

15.65% |

15.08% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

M. Clint Green - President and Chief Executive Officer

Eric A. Scheller - Vice President and Chief Operating Officer

Christopher M. Paulsen - Vice President; Chief Financial Officer and Treasu

Christopher W. Porter - Vice President; General Counsel and Secretary

Dylan A. Bramhall - Director

|

|

Peer Information

USA Compression Partners, LP (WFTIQ)

USA Compression Partners, LP (KGS)

USA Compression Partners, LP (CAM.1)

USA Compression Partners, LP (PGEO)

USA Compression Partners, LP (UFAB.)

USA Compression Partners, LP (POWR.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL FLD MCH&EQP

Sector: Oils/Energy

CUSIP: 90290N109

SIC: 4922

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/17/26

|

|

Share - Related Items

Shares Outstanding: 122.68

Most Recent Split Date: (:1)

Beta: 0.23

Market Capitalization: $3,263.42 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 7.89% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.31 |

Indicated Annual Dividend: $2.10 |

| Current Fiscal Year EPS Consensus Estimate: $1.27 |

Payout Ratio: 2.50 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/26/2026 - $0.52 |

| Next EPS Report Date: 02/17/26 |

|

|

|

| |