| Zacks Company Profile for Vital Farms, Inc. (VITL : NSDQ) |

|

|

| |

| • Company Description |

| Vital Farms Inc. offers a range of produced pasture-raised foods. Its product, including shell eggs, butter, hard-boiled eggs, ghee and liquid whole eggs. Vital Farms Inc. is based in AUSTIN, Texas.

Number of Employees: 598 |

|

|

| |

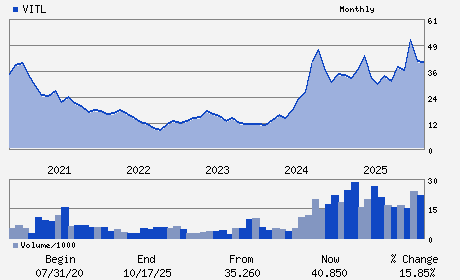

| • Price / Volume Information |

| Yesterday's Closing Price: $28.41 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,614,657 shares |

| Shares Outstanding: 44.78 (millions) |

| Market Capitalization: $1,272.04 (millions) |

| Beta: 1.10 |

| 52 Week High: $53.13 |

| 52 Week Low: $25.51 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.87% |

-1.40% |

| 12 Week |

-11.39% |

-14.41% |

| Year To Date |

-11.05% |

-10.93% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Russell Diez-Canseco - President and Chief Executive Officer

Matthew O'Hayer - Executive Chairperson and Director

Thilo Wrede - Chief Financial Officer

Kofi Amoo-Gottfried - Director

Glenda Flanagan - Director

|

|

Peer Information

Vital Farms, Inc. (CDSCY)

Vital Farms, Inc. (HDNHY)

Vital Farms, Inc. (CPB)

Vital Farms, Inc. (AMNF)

Vital Farms, Inc. (GMFIY)

Vital Farms, Inc. (BRID)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FOOD-MISC/DIVERSIFIED

Sector: Consumer Staples

CUSIP: 92847W103

SIC: 2000

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/26/26

|

|

Share - Related Items

Shares Outstanding: 44.78

Most Recent Split Date: (:1)

Beta: 1.10

Market Capitalization: $1,272.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.41 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.64 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 02/26/26 |

|

|

|

| |