| Zacks Company Profile for Vornado Realty Trust (VNO : NYSE) |

|

|

| |

| • Company Description |

| Vornado Realty Trust, a real estate investment trust (REIT), is the owner and manager of the commercial real estate in the United States, with a portfolio concentrated in the New York City, Chicago and San Francisco. The company has partnership with Alexander's, Inc. In New York, the company also owns signage throughout the Penn District and Times Square as well as Building Maintenance Services LLC, a wholly owned subsidiary, that provides cleaning and security services for Vornado's buildings and third parties. In addition, Vornado has the MART in Chicago and more than 500 California Street property in San Francisco. The company owns and manages more than 26 million square feet of Leadership in Energy and Environmental Design (LEED) certified buildings. Vornado completed the development phase of a residential condominium tower, 220 Central Park South.

Number of Employees: 3,145 |

|

|

| |

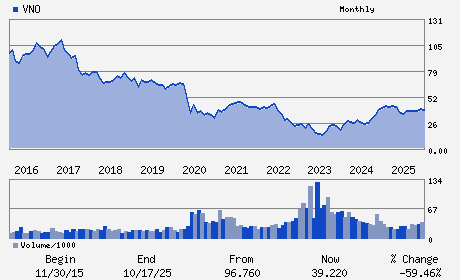

| • Price / Volume Information |

| Yesterday's Closing Price: $29.89 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,137,008 shares |

| Shares Outstanding: 190.67 (millions) |

| Market Capitalization: $5,699.02 (millions) |

| Beta: 1.52 |

| 52 Week High: $43.37 |

| 52 Week Low: $28.08 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-11.17% |

-9.82% |

| 12 Week |

-11.67% |

-14.69% |

| Year To Date |

-10.19% |

-10.06% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

888 SEVENTH AVE

-

NEW YORK,NY 10019

USA |

ph: 212-894-7000

fax: 201-587-0600 |

None |

http://www.vno.com |

|

|

| |

| • General Corporate Information |

Officers

Steven Roth - Chief Executive Officer and Chairman

Michael J. Franco - President and Chief Financial Officer

Deirdre Maddock - Chief Accounting Officer

Candace K. Beinecke - Trustee

Michael D. Fascitelli - Trustee

|

|

Peer Information

Vornado Realty Trust (ARE)

Vornado Realty Trust (CUZ)

Vornado Realty Trust (FUR)

Vornado Realty Trust (NNN)

Vornado Realty Trust (FCH)

Vornado Realty Trust (CTO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST -OTHER

Sector: Finance

CUSIP: 929042109

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 190.67

Most Recent Split Date: 10.00 (2.00:1)

Beta: 1.52

Market Capitalization: $5,699.02 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.48% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.60 |

Indicated Annual Dividend: $0.74 |

| Current Fiscal Year EPS Consensus Estimate: $2.37 |

Payout Ratio: 0.32 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: -0.15 |

| Estmated Long-Term EPS Growth Rate: 2.43% |

Last Dividend Paid: 12/18/2025 - $0.74 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |