| Zacks Company Profile for Whitestone REIT (WSR : NYSE) |

|

|

| |

| • Company Description |

| Whitestone REIT is a fully integrated real estate investment trust that acquires, owns, manages, develops and redevelops high quality `internet-resistant` neighborhood, community and lifestyle retail centers. Whitestone's properties are principally located in Austin, Dallas-Fort Worth, Houston, San Antonio and Phoenix, which are among the fastest-growing markets in the country with highly educated workforces, high household incomes and strong job growth. The Company's strategy is to target shifting consumer behavior and purchasing patterns by creating a complementary mix of grocery, dining, health and wellness, education, services, entertainment and specialty retail in its properties. Whitestone's national, regional and local tenants provide daily necessities, needed services and convenience to the community which are not readily available online. Whitestone is headquartered in Houston, Texas.

Number of Employees: 72 |

|

|

| |

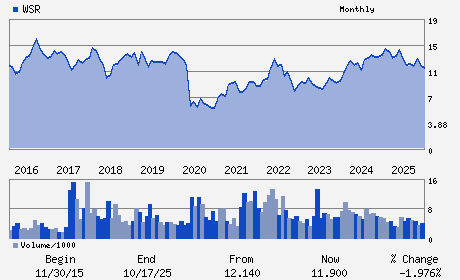

| • Price / Volume Information |

| Yesterday's Closing Price: $15.21 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 176,224 shares |

| Shares Outstanding: 51.02 (millions) |

| Market Capitalization: $776.02 (millions) |

| Beta: 0.81 |

| 52 Week High: $15.29 |

| 52 Week Low: $11.43 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.64% |

9.28% |

| 12 Week |

13.51% |

9.64% |

| Year To Date |

9.50% |

9.65% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

David K. Holeman - Chief Executive Officer

Amy S. Feng - Chairman

John S. Hogan - Chief Financial Officer

Jeffrey A. Jones - Trustee

Julia B. Buthman - Trustee

|

|

Peer Information

Whitestone REIT (ARE)

Whitestone REIT (CUZ)

Whitestone REIT (FUR)

Whitestone REIT (NNN)

Whitestone REIT (FCH)

Whitestone REIT (CTO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST -OTHER

Sector: Finance

CUSIP: 966084204

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/25/26

|

|

Share - Related Items

Shares Outstanding: 51.02

Most Recent Split Date: (:1)

Beta: 0.81

Market Capitalization: $776.02 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.55% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.27 |

Indicated Annual Dividend: $0.54 |

| Current Fiscal Year EPS Consensus Estimate: $1.13 |

Payout Ratio: 0.51 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/01/2025 - $0.05 |

| Next EPS Report Date: 02/25/26 |

|

|

|

| |