| Zacks Company Profile for WisdomTree, Inc. (WT : NYSE) |

|

|

| |

| • Company Description |

| WisdomTree Inc. is a financial innovator, offering a well-diversified suite of exchange-traded products, models and solutions. It involved in developing digital products and structures, including digital funds and tokenized assets, as well as our blockchain-native digital wallet, WisdomTree Prime(TM). WisdomTree Inc., formerly known as WISDOMTREE INV, is based in NEW YORK.

Number of Employees: 313 |

|

|

| |

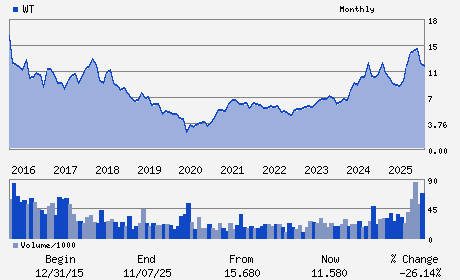

| • Price / Volume Information |

| Yesterday's Closing Price: $16.36 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,092,579 shares |

| Shares Outstanding: 140.71 (millions) |

| Market Capitalization: $2,302.10 (millions) |

| Beta: 1.09 |

| 52 Week High: $17.09 |

| 52 Week Low: $7.47 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

15.05% |

16.87% |

| 12 Week |

52.47% |

45.84% |

| Year To Date |

34.21% |

34.21% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jonathan Steinberg - Chief Executive Officer and Director

Smita Conjeevaram - Non-Executive Chairman of the Board

Bryan Edmiston - Chief Financial Officer

Lynn S. Blake - Director

Anthony Bossone - Director

|

|

Peer Information

WisdomTree, Inc. (EIIN)

WisdomTree, Inc. (AFMI)

WisdomTree, Inc. (DRL)

WisdomTree, Inc. (GRFPY)

WisdomTree, Inc. (IGOT)

WisdomTree, Inc. (ATLC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-MISC SVCS

Sector: Finance

CUSIP: 97717P104

SIC: 6211

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/01/26

|

|

Share - Related Items

Shares Outstanding: 140.71

Most Recent Split Date: (:1)

Beta: 1.09

Market Capitalization: $2,302.10 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.73% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.24 |

Indicated Annual Dividend: $0.12 |

| Current Fiscal Year EPS Consensus Estimate: $1.10 |

Payout Ratio: 0.14 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: -0.17 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 11/12/2025 - $0.03 |

| Next EPS Report Date: 05/01/26 |

|

|

|

| |